Market Updates

At the time of writing, the Nasdaq is only around 10% from its end-2021 all-time high – a point at which we were writing about some of the most extreme valuation excesses of all time. While the drivers today are different (the profitless tech bubble remains popped for now) the longer this rally goes on, the closer we think we’ll be getting back to those extremes:

At the other end of the spectrum we saw the UK mid-cap FTSE 250 index (light blue line) falling by 1.5%, continuing its run of disappointing returns. This index is more domestically focused than the FTSE 100 and has been hit hard by poor macroeconomic news flow. However, this part of the UK market is now extremely cheap, trading on a forward price/earnings ratio of less than 10x with earnings estimates still rising.

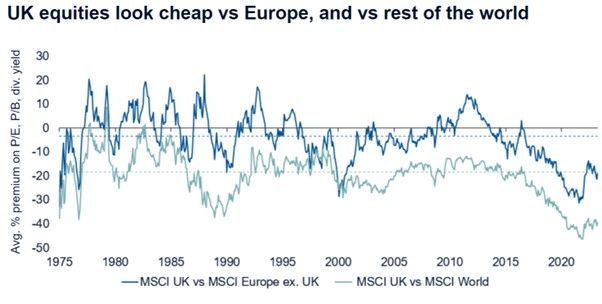

The relative cheapness of UK equities is something we’ve touched on many times in previous notes, and despite better performance for the FTSE 100 last year, the UK market as a whole remains deeply undervalued and underowned versus other major regions. The second chart below neatly illustrates this by showing the relative valuation of the MSCI UK index versus Europe (dark blue line) and the World index (light blue line) which is heavily weighted towards US equities. The lower the line moves, the cheaper UK equities are being priced relative to their peers. In both cases it is clear that UK equities are significantly undervalued relative to history; versus Europe we need to go back to the 1970s to find a time when UK equities were similarly unloved. Importantly this all comes at a time when corporate earnings momentum in the UK remains strong:

In bonds as the third chart below shows, we saw positive returns most notably for high yield bonds (yellow line) which rose by 2.6% in line with generally positive, risk-on sentiment. In this environment government bonds struggled again, with US Treasuries falling by around 0.8% during the month. Gilts also fell by 0.5%, continuing their run of poor performance. Gilts are down around 4% in 2023 to date, while US and European equivalents are up 1.6% and 2.5% respectively:

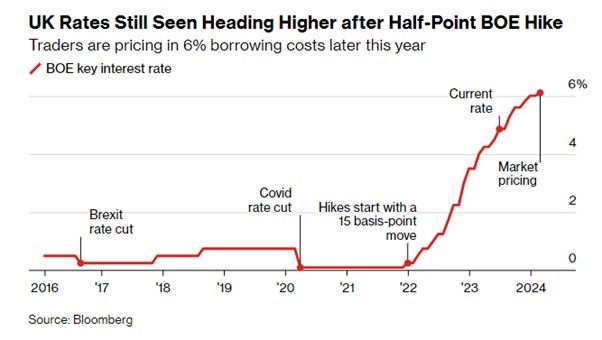

As we’ve also spoken about in previous months, the UK has stood out this year in particular for its continued high levels of inflation and red-hot labour market. As a result, the Bank of England has now started to respond aggressively in kind, surprising markets with a 0.5% rate hike in June to bolster its inflation-fighting credibility, and backing the move up with tougher rhetoric; promising to do “what is necessary” to bring inflation back to 2%.

Investors have subsequently priced in a much higher peak for UK interest rates in 2024 of over 6% (6.5% at the time of writing) as the fourth chart below shows, and crucially they expect interest rates to stay at those elevated levels for an extended period of time. This is a much more hawkish position than was predicted just a few months ago, meaning the BoE’s actions are starting to have the desired effect:

Because of this, Gilt yields do now look relatively attractive versus US or European equivalents. The fifth chart below shows 10-year government bond yields for a range of countries, with UK Gilts (black line) currently generating a 4.4% yield; significantly in excess of other peer countries. Perhaps counterintuitively, given the BoE’s recent harder line approach, there is now a great potential for Gilts to offer some upside for investors as their actions have a greater chance now of inducing a growth and demand-led inflation slowdown:

Looking ahead, while coincident macroeconomic data remains robust, there are warning signs flashing from the global manufacturing sector, and from measures of consumer and investor sentiment. For now we still see the global economy demonstrating resilience in the face of tighter monetary and fiscal policy, but slowdowns are still forecasted for later this year and into 2024. As always, portfolio diversification remains essential.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.