Pension & retirement

But if the day to day demands of being a dentist has taken up so much of your time and attention that you have overlooked your financial future, you could be bracing yourself for a rocky road ahead.

The good news is that whether you’re a working dentist with an NHS pension or a practice owner, expert financial advice can help you to navigate complex scenarios and give you financial peace of mind.

Meanwhile here are a few financial guidelines to help you get your teeth into preparing for your retirement.

The earlier you start saving for retirement, the better; time is your greatest ally when it comes to building a robust nest egg. By starting early, you allow your investments to grow and compound over the long term.

You can also take advantage of tax-advantaged accounts, such as personal pensions or self-invested personal pensions (SIPPs). By contributing the maximum amount allowed you can leverage government tax relief on contributions.

Before you embark on your retirement journey, it’s essential to set clear goals. Think about your desired retirement lifestyle and estimate the financial resources you’ll need to support it.

Consider factors such as living expenses and healthcare costs as by defining your retirement goals, you can create a targeted savings plan.

If you are a dentist working in the National Health Service (NHS), familiarise yourself with the NHS pension scheme. Understand its benefits, contribution rates, and retirement options. The NHS pension can be a valuable component of your retirement strategy. Stay informed about any changes or reforms to the scheme and ensure you optimise its potential benefits.

Diversification is key to building a resilient retirement portfolio. Spread your investments across various asset classes, such as stocks, bonds, and property. By diversifying, you can manage risk and maximise potential returns.

Regularly review and adjust your investment portfolio to ensure it remains aligned with your retirement goals and attitude to risk. A financial adviser will help you to optimise your investment strategy.

The financial performance of your dental practice plays a vital role in your retirement planning as a thriving practice can significantly contribute to your retirement savings.

Continuously assess ways to optimise revenue, control expenses, and improve profitability and stay updated with regulations and reimbursement systems.

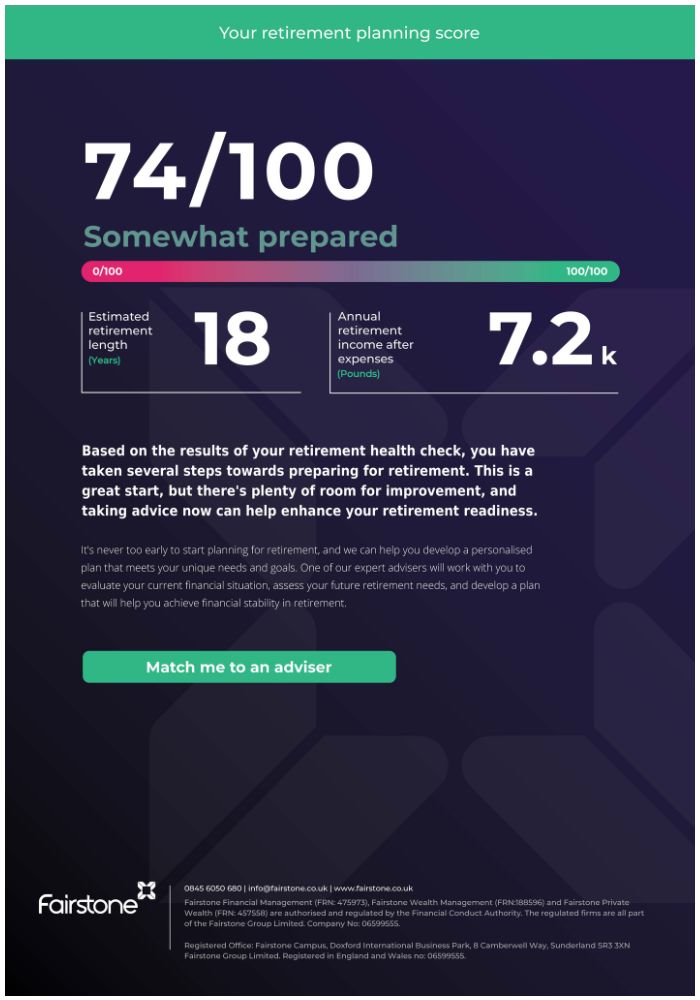

DIY Retirement Health CheckComplete our retirement health check today. Answer 5 quick questions to determine whether you’re ready for retirement. |

|

If you plan to sell your dental practice as part of your retirement strategy, start planning well in advance.

Seek professional advice from specialists in dental practice transitions. They can guide you through the process, ensuring a smooth transition and maximising the value of your practice.

Safeguarding your retirement savings is paramount. Obtain adequate insurance coverage, including professional indemnity insurance, disability insurance, and life insurance. These policies protect you from unexpected events that could jeopardise your retirement plans.

Stay up-to-date with the latest financial trends and retirement planning strategies; knowledge is your ally in making informed decisions.

Consider the costs of healthcare in retirement, including potential long-term care expenses. Explore options such as long-term care insurance and factor these expenses into your retirement savings plan.

Just as you wouldn’t expect a financial planner to perform their own dentistry, it’s essential to recognise that financial planning requires the skills of experts.

By working with professionals, dentists can receive personalised guidance, maximise tax advantages, diversify investments, and develop a comprehensive plan tailored to their goals. This allows dentists to focus on their core expertise of providing excellent dental care while having the peace of mind that their retirement plan is in capable hands.

| Complete our retirement health check | Match me to an adviser |