With Easter just around the corner, I’d like to talk about chocolate.

In fact, one particular type of chocolate: the Freddo bar.

Those of a certain age may remember this piece of confectionery with great fondness – not so much for its taste, which was, well, chocolatey, but more for its value for money.

Freddos were cheap.

So cheap in fact that right up until 2006 you could buy one for as little as 10p.

Sadly those days are long gone.

A Freddo these days will set you back around 35p and, in some cases, as much as £1 a bar.

Even with increases in pocket money, that chocolate hit is no longer as attainable as it once was.

The plight of the once-cheap Freddo illustrates an important point about the value of money: it never stays the same.

Inflation is the silent assassin of your wealth, affecting everything from buying a once in a lifetime holiday to grabbing a sweet snack.

While the rate of inflation fluctuates, it rarely if ever recedes. Just like the oceans continually erode the coastline, inflation does the same to cash in bank accounts.

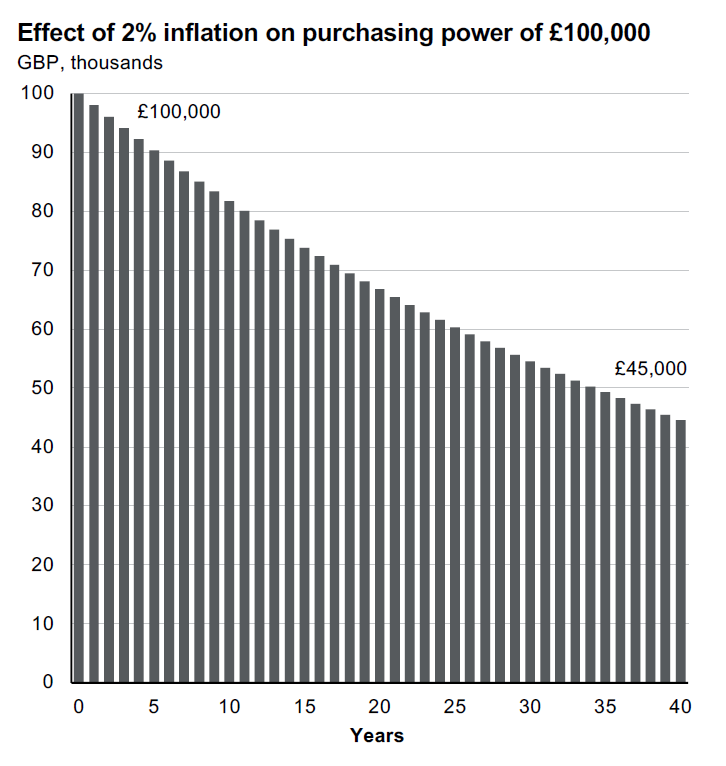

The effect on your cash over time really adds up – in a bad way. This picture tells the real story:

It’s a sobering illustration of the power of inflation – even more so when you realise that this is inflation at just 2% rather than the 3% it was in January, let alone the 10%+ it hit in January 2023.

If you still think that ‘cash is king’ or that your money is always ‘safe’ in cash, you may want to think again.

The unfortunate fact of the matter is that interest rates on bank or building society deposits rarely keep pace with inflation.

Your money may be ‘safe’ in a savings account (providing you have deposits of £120,000 or less and your account provider is covered by the FSCS deposit guarantee). However, the value that it represents is not.

Building up an ‘emergency’ fund of savings which you can quickly and easily access is a great idea, but putting all your ‘rainy day’ money in such an account risks losing some of the value of what you have put aside, particularly over a longer timescale.

We in the financial services sector rightly have to warn of the risk involved in investing – that returns are not guaranteed, the value of what people invest can go down as well as up and people may not get back the full amount they invest.

However, there is also a type of risk involved in placing all your spare funds in a savings account: you may find your money is not worth as much as you had thought and, with tax rates on interest from non-ISA savings accounts increasing, you may not earn as much in interest as you had anticipated.

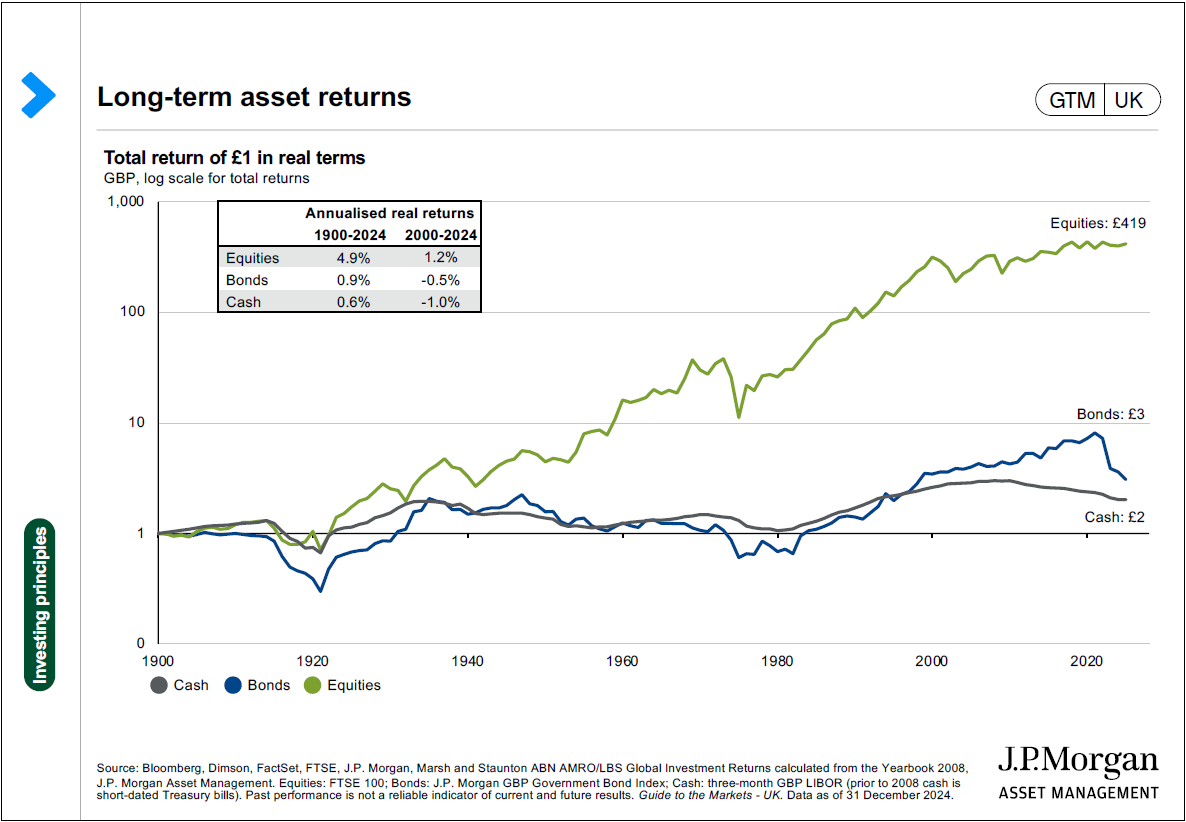

You may also miss out on the additional returns which could have come with investing over the long term – while past performance does not mean the same will be repeated in the future, it remains a fact that over a long period of time, returns from equities have typically outperformed cash by several multiples.

Financial decisions should always take into account your individual circumstances, but taking a balanced approach to saving and investing could help to mitigate both types of risk involved.

And you could end up being able to buy a Freddo or two.

It’s easy to find out more about how investing has the potential to improve your financial future, what products are out there and how to match your goals with your appetite for risk.

Get in touch with a Fairstone adviser to discover more.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

| Match me to an adviser | Subscribe to receive updates |

The deadline to maximise your investment in tax-free ISAs (Individual Savings Accounts) is rapidly approaching.

The ISA deadline comes at the end of the current 2025/26 tax year, which is April 5, 2026.

This is the last chance to use up your annual allowance before it expires, with the new tax year starting on April 6, 2026.

You can invest up to a maximum of £20,000 per person in any ISA in any one tax year.

This allowance has to be used during the course of that tax year and cannot be “rolled over” into the subsequent tax year.

It is a “use it or lose it” allowance.

At the current moment in time, the £20,000 maximum can be invested across any number of ISA types, including cash ISAs, stocks and shares ISAs or Lifetime ISAs.

You can invest in more than one ISA account during any tax year.

However, your total ISA investments cannot add up to more than £20,000.

No. Putting money into a Junior ISA does not affect your personal adult allowance of £20,000 per tax year.

The Junior ISA has its own separate £9,000 annual limit that any adult can contribute to.

This means that grandparents, family and friends can all contribute to a Junior ISA without it affecting their own personal ISA allowance.

Find out more about Junior ISAs in our guide.

Yes. From April 2027, people aged under 65 will only be allowed to invest a maximum of £12,000 in a cash ISA in any one financial year.

The remaining £8,000 of their annual £20,000 allowance has to be invested in a stocks and shares ISA.

Those aged over 65 can still use all of their £20,000 annual allowance to invest in a cash ISA.

Maximising the amount you can invest tax-free in ISA accounts can help to make your money work harder.

It allows you to retain the proceeds of your investment tax-free.

This is particularly important as the 2025 Budget announced rises in taxation rates on dividend income from 6 April 2026 and on savings and property income from 6 April 2027.

Keeping your investments in a tax-free ISA wrapper shields them from these rises.

Every person’s financial situation is different so there may be a good reason why you might want to wait until April.

However, if you want to maximise your ISA allowance and can do so at a time of your choosing, investing as early as possible will allow you to shelter your money tax-free for longer.

It is also the case that many ISA providers are extremely busy the closer the deadline approaches so investing earlier will enable you to avoid the rush.

Taking independent financial advice can help you decide whether an ISA is right for you and what types of ISA could best suit your circumstances and attitude to risk.

To start your ISA journey, get in touch with an adviser today.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

Pssst! Want some free money?

Hopefully that has got your attention.

This isn’t my money we’re talking about, but funds from a far better capitalised source: the Government.

That may sound surprising, but despite the well-publicised tax rises from the last two Budgets, the Government does give out money as well as taking it away.

I’m not talking about statutory benefits such as the State Pension or child benefit.

What I’m referring to are the incentives which the Government gives for people to save and invest.

All too often, people are either unaware of these incentives or end up missing out because they don’t take action soon enough.

Let’s take Individual Savings Accounts (ISAs) to start with.

As you may be aware, ISAs are accounts where you can enjoy the proceeds free of tax, whether that’s in the form of a cash ISA, stocks & shares ISA or Lifetime ISA (although these are being phased out).

You can save or invest up to £20,000 across all your adult ISAs each tax year and all interest, dividends, or capital gains within an ISA are tax-free.

The ISA deadline for the current tax year is rapidly approaching – it’s April 5th.

If you can afford to and it forms part of your financial plan, you really should take advantage of the opportunity to maximise tax-free ISAs as much as you can.

While the value of investments in stocks and shares ISAs can fall as well as rise, in the long-term – as I referred to last month – investing money has outperformed returns on cash.

Putting some of your investments in an ISA shelters them from tax and, if you do this regularly, the potential to see your money grow is compelling.

“But this isn’t free money,” you might argue, but tax-free makes a material difference to investment returns.

However, when it comes to pensions, there really is free money for our clients.

If you save in a workplace pension, your contributions are made from pre-tax income, thus saving you anything from 20% to 45% according to the size of your wage packet.

Still not free money?

OK, how about the fact that if you have a private pension – such as one which you’ve created from consolidating pensions from previous workplaces – and you put money into that from your post-tax income, the Government will add 20p to 45p in tax relief for every £1 you put in, depending on your tax rate.

While this is subject to various income and contribution limits, it is without doubt free money.

What’s more, the Government will also give free money to your children or grandchildren.

Any parent can set up a child’s pension for their child.

It doesn’t have to start with a huge lump sum or have vast amounts put into it.

Regular contributions – even small ones – can really add up over time and make a nest egg for later life.

What’s more, other family members – such as grandparents, aunts and uncles – and family friends can also contribute.

Currently a maximum of £2,880 can be paid into a child’s pension for any one tax year.

And – here’s where the free money comes in – the Government will pay 20% tax relief on those contributions, making it £3,600 a year before a single penny has been earned from investments.

Start early, contribute regularly and your child could potentially have a £1m pension pot by the time they can access it – at age 58 under current legislation.

Investing in a Junior ISA can also give your children a great start to their adult lives.

Junior ISA contributions don’t count towards your personal ISA allowance. Up to £9,000 a year can be put into a Junior ISA in any one tax year and your child gets to keep all interest, dividends, or capital gains tax-free when they turn 18.

There really is no time like the present to make a start on making a difference to your life or the lives of your children.

It worked for me – my daughters have house deposits as a result of Junior ISAs started when they were babes in arms.

They also have started pensions to capture the free money and harness the power of compound investment returns to unlock the financial independence that a £1m pension pot provides.

It’s also easy to do. Get in touch with a Fairstone adviser to find out how you can make the most of what is on offer and how that could fit into your financial life.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

| Match me to an adviser | Subscribe to receive updates |

Financial planning as a couple doesn’t sound like the most romantic thing in the month of Valentine’s Day.

However, taking time to talk about shared financial goals does not just make practical sense – it can actually enhance your relationship.

Here we outline why financial planning could be the key to your shared future happiness as a couple.

“Not enough” would seem to be the answer.

Recent research from Opinium found that one in four people (26%) in long-term relationships (lasting two or more years) manage their lives together but not their finances.

It also found that:

Not only do people not talk about their finances to their partner – sometimes they actively cover them up.

Research from Co-op Legal Services found that one in three married people aged over 65 hide money from their spouse.

One in seven of those who admitted hiding money said they had £50,000 or more stashed away on the quiet.

Aside from the obvious reason that concealing important things from your partner is rarely a good idea, there are several practical areas where not communicating with each other about finance can create problems.

And conversely, talking things over about money matters can really reap dividends.

If you’re setting up home together, not only should you plan how you’re going to pay for where you live, but mortgage lenders will insist that you do.

Aside from the demands of lender application forms, talking about your mortgage with your partner is crucial in a number of ways.

For example, what size deposit can you afford and how should you finance it?

A larger deposit often means you can get a better mortgage deal but it’s important that both parties feel they have equal stakes in the property – even if one party is putting in more money than the other.

It’s also good to talk about how long you want the mortgage to last.

For example, if there is an age difference in the relationship, one party might be close to retirement by the time the house is paid for while the other has several years of working life left.

Such practical considerations naturally lead to more discussions about life goals and what kind of future you’re looking at together.

This can bring you as a couple closer together – or if it doesn’t, at least you know how the other person in the relationship feels.

If you’ve discussed getting a home together and the mortgage you need to pay for it, talking about how you’ll protect each other – and the rest of your family – if the worst should happen is an obvious next step.

Life insurance policies are generally cheaper the earlier in life that you take them out, so ensuring you and your partner are covered in the event of a death is a very good idea.

Talking about how much cover is needed and nominating the person to whom money should be paid is important to make sure your loved ones are covered – and it can bring real peace of mind to your relationship.

Protection isn’t just about what could happen in a worst case scenario.

Talking about how you would cope financially in the event of a serious illness, accident or unemployment will help you decide whether one or both of you should take out cover to protect against such occurrences.

Financial conversations shouldn’t just be about the nasty things in life.

Talking about how you will plan for your children’s future is really important and can give your offspring a great start in life and a comfort for their later years.

For example, you might want to start a Junior ISA for your child so that they have a valuable nest egg available to them once they hit 18.

You could also consider starting a child’s pension which other members of the family could contribute to and which could give them security for their later years.

Both of these products have implications for tax and for personal allowances – another reason to get together and discuss plans before carrying them out.

This is also the case for things like childcare allowances and vouchers, maternity pay and other family-related schemes.

This means it’s crucial that you both know where you stand when it comes to your finances in order to get the best deal for your family.

As the Opinium survey found, talking about retirement and sharing details of pension savings is an area many shy away from.

However, a couple considering retirement are so much better equipped for that phase of life if they put their heads together and plan as one.

Let’s take a very obvious thing: how much money do you need to have an enjoyable retirement?

The Retirement Living Standards have been developed by Pensions UK to help people picture what kind of lifestyle they could have in retirement and the costs involved.

There are a number of assumptions involved in their calculations – including people owning their own home, taxation levels and no social care costs – but the basic figures illustrate why two heads are better than one in retirement.

At each level of income – minimum, moderate and comfortable – the amount needed per person is considerably less for couples than it is for single people:

| Lifestyle level | Single person | Couple |

| Minimum | £13,400 a year | £21,600 a year |

| Moderate | £31,700 a year | £43,900 a year |

| Comfortable | £43,900 a year | £60,600 a year |

In addition to planning how you’ll finance your retirement, it’s also a good idea to talk about what each of you wants from this phase of your life.

For example, you might both want to go on a dream holiday or even buy a holiday home.

One of you might want to continue doing some part-time work while the other is content to put their feet up.

All of these decisions have consequences for your retirement finances and for things like how much of your pension pot you want to take as a tax-free lump sum or whether one or both of you should buy an annuity to give you guaranteed income for the remainder of your life.

Planning together will make such decisions easier to come by and will help you visualise and secure your lives in retirement.

What happens after you’ve gone is something that can be difficult for people to address.

Talking with your partner about the issue can put practical plans in place and provide real peace of mind for both of you.

As with all of these stages in life, bringing in an expert adviser can provide a neutral voice and independent advice on the best way forward.

Getting expert advice on putting a will in place and planning what happens with your estate can:

It’s particularly important for couples to co-ordinate on this process because of factors such as transferrable allowances and inheritance tax nil rate bands.

The worlds of romance and finance may seem to be very far apart.

Yet couples who don’t engage with each other when it comes to money matters can make life difficult for themselves and their loved ones.

Conversely, planning the future together can actually bring you closer together and demonstrate the real commitment you have for each other.

Expert, independent financial advice can help you to map out and achieve a future which you both want.

From setting up home to what happens after you’ve gone, we can assist at every stage with practical, actionable insights.

To find your perfect financial advice partner, get in touch today.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

| Match me to an adviser | Subscribe to receive updates |

Couples financial planning involves partners working together to manage money, set shared goals and plan for life events such as buying a home, raising children, retirement and estate planning.

Open financial conversations build trust, reduce misunderstandings and help couples make better long-term decisions about savings, investments and protection.

There is no one-size-fits-all answer. Some couples combine finances fully, others partially, and some keep them separate. The key is transparency and agreement on shared goals.

The earlier the better. Major life events such as moving in together, buying a home, having children or planning retirement are ideal times to start.

A financial adviser provides impartial guidance, helps align goals, identifies risks and creates a tailored financial plan covering mortgages, protection, pensions and estate planning.

Investors today face a wide range of choices when building long-term wealth, with one of the most fundamental decisions whether to invest actively or passively.

While both approaches aim to grow capital over time, they differ meaningfully in philosophy, implementation and responsiveness to changing market conditions.

Understanding these differences is essential – not only when selecting the most appropriate strategy for you, but also in appreciating how active and passive approaches can work together within a well-constructed portfolio.

Active investing relies on the expertise of professional fund managers who carefully research and select investments with the aim of delivering returns above a specific market benchmark.

Managers assess individual companies by looking at factors such as how competitive they are, the quality of their leadership, future growth opportunities, and wider economic and political trends.

Their goal is to invest in companies that appear attractively valued and have strong long-term potential, while reducing or exiting positions where prospects are weakening.

One of the main advantages of active investing is its flexibility, particularly during periods of market uncertainty.

Active managers can adjust portfolios by reducing exposure to higher-risk areas, increasing diversification, or holding cash temporarily to help protect capital when markets are under pressure.

That said, active investing also comes with considerations.

Active funds typically charge higher fees to cover the cost of research and ongoing management, which can reduce returns if a manager does not outperform.

Performance also depends on the manager’s skill and judgement, meaning results can vary over time.

Passive investing takes a different approach, aiming to match the performance of a market index – such as the FTSE 100 – rather than outperform it.

Passive funds do this by holding the same companies, in the same proportions, as the index they track – such as the FTSE 100 or S&P 500.

Rather than trying to identify individual winners, the focus is on capturing the overall return of the market.

One of the key benefits of passive investing is its low cost.

Because passive funds require less day-to-day decision-making and research, fees are typically lower than those of active funds.

Over long periods, these cost savings can make a meaningful difference to overall returns.

Passive investing also offers simplicity and transparency, as investors can clearly see which markets they are invested in and how their portfolios are constructed.

However, passive investing also has limitations.

Passive funds do not adjust in response to changing market conditions.

When markets fall, passive strategies will reflect those declines and must rely on a subsequent recovery.

As a result, passive investing is generally best suited to investors with a long-term outlook who are comfortable riding out periods of market volatility.

During periods of steady economic growth and rising markets, passive investing can be a very effective approach, allowing investors to benefit from broad market gains in a simple and cost-efficient way.

Lower fees also help support returns over the long term.

Looking ahead, however, the investment environment appears more challenging.

Increased geopolitical uncertainty, changes in monetary policy, uneven performance across sectors and higher market volatility mean returns may be less consistent.

In these conditions, the gap between stronger and weaker companies often widens, creating both risks and opportunities.

Historically, this type of environment has tended to favour active management, where careful selection and flexibility can add value.

For many investors, the higher costs associated with active investing, along with the risk that a manager may not consistently add value, make a fully active approach less appealing.

As a result, rather than choosing between active and passive investing, many investors opt for a blended approach, combining elements of both.

One way this can be achieved is by using active asset allocation alongside a core passive portfolio – an approach adopted within the Fairstone Pure Passive MPS range.

Passive funds are tied closely to index structures and cannot adjust when certain regions, sectors or asset classes become overvalued or overly concentrated.

Active asset allocation provides the flexibility to rebalance portfolios over time – tilting towards more attractively valued areas, introducing defensive assets such as bonds or alternatives, and managing risk as market conditions change.

Similarly, blending active and passive funds – the approach taken within the Fairstone Nova MPS range – allows investors to benefit from low-cost market exposure while selectively allocating to active strategies in areas where skill, flexibility and insight have the greatest potential to add value.

Ultimately, both active and passive investing offer clear benefits, and neither approach is right in every situation.

The most suitable option depends on your individual goals, investment timeframe, tolerance for risk and how closely you wish to engage with your investments.

Passive strategies can be particularly effective during periods of steady economic growth, providing broad market exposure in a simple and cost-efficient way.

Active management, meanwhile, may add value in more uncertain or volatile environments, where flexibility and careful investment selection become increasingly important.

For many investors, a blended approach offers the most balanced solution—combining the efficiency of passive investing with the adaptability and insight of active management.

By using both approaches together, portfolios can remain cost-effective while retaining the flexibility to respond to changing market conditions.

Whichever approach is taken, it is important to remember that markets will rise and fall over time.

Maintaining patience, diversification and a disciplined long-term perspective remains key to achieving successful investment outcomes.

For expert advice on investment approaches and which could work best for you, contact one of our advisers today.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

| Match me to an adviser | Subscribe to receive updates |

The main difference between active and passive investing is how investments are managed.

Active investing involves professional fund managers selecting individual investments with the aim of outperforming a market benchmark.

Passive investing aims to match the performance of a market index by holding the same investments in the same proportions, with no attempt to outperform the market.

Neither active nor passive investing is universally better.

Passive investing can be effective during periods of steady market growth due to its low cost and broad market exposure.

Active investing may add value during more volatile or uncertain market conditions, where flexibility and careful investment selection can help manage risk and identify opportunities.

Passive investing typically costs less because passive funds do not require ongoing research, stock selection or frequent trading.

By simply tracking an index, passive funds have lower operating costs, which are reflected in lower fees for investors.

Yes, it is possible to lose money with passive investing.

Passive funds fully reflect market movements, meaning when markets fall, the value of the investment will also decline.

Passive investing is therefore best suited to long-term investors who are comfortable with short-term market volatility.

No, active investing does not always outperform the market.

While some active managers can add value, especially in certain market conditions, performance depends on the manager’s skill and judgement.

Higher fees also mean active managers must outperform by a sufficient margin to deliver better net returns than passive funds.

For many investors, a blended approach can be beneficial.

Combining active and passive investing allows investors to benefit from low-cost market exposure while selectively using active strategies in areas where flexibility and expertise may add value.

This approach can help balance cost efficiency with risk management.

A blended portfolio may suit investors who want long-term growth, cost efficiency and the ability to adapt to changing market conditions.

It is often appropriate for investors who prefer a diversified approach without relying entirely on either active or passive investing.

Choosing between active, passive or blended investing depends on your financial goals, time horizon, tolerance for risk and personal preferences.

Speaking with a financial adviser can help determine the most suitable strategy and ensure your investments remain aligned with your long-term objectives.

Hello!

Just to introduce myself, I’m Russell Bignall and I’m the Group Managing Director here at Fairstone.

This is the first in a series of regular columns where you’ll be hearing from me and other members of the team.

I have to start with a confession: I enjoyed Christmas perhaps a little too much.

I have a terrible weakness for a good cheeseboard so I found myself in the first week of January sweating it out in the gym trying to make up for my sins.

It’s a slight consolation to know I wasn’t the only one – I’m sure many of you would have been in a similar position (or at least thinking about it) as so many of us try to turn over a new leaf in the New Year.

Yet while people often think about shedding a few pounds in January, not enough of us consider the thousands of pounds we could be saving by investing our money.

Let’s take the past year as an example.

If you’d invested the maximum ISA allowance of £20,000 at the start of the 2025/26 tax year into a cash ISA at the best available rate of 4.33%, your money would have grown to £20,645 by the end of 2025.

Not bad, you might think.

Yet if you’d invested the same amount in an ISA on the Fairstone Nova 9 model portfolio over the same period of time, your money would have grown to £24,300.

While investment returns aren’t guaranteed, you can see how a similar performance over the course of a number of years could make a huge difference to how much your money grows.

You don’t need to take my word for it.

Even the Chancellor Rachel Reeves in her Budget speech pointed out how that someone who had invested £1,000 a year in an average stocks and shares ISA every year since 1999 would be £50,000 better off than if they’d put the same money into a cash ISA.

Look over a longer term and you can see the difference between investing money and keeping it in cash:

And the other thing to bear in mind is the fact that, much like me with the Christmas cheeseboard, inflation will keep eating away, reducing the amount your money is worth:

While everyone needs a ‘rainy day’ fund to cope with unforeseen emergencies, investing money with the help of expert advice can be a life-changing decision.

This applies not just to your own finances, but for those of your nearest and dearest.

Investments like a Junior ISA or a child’s pension can make even small amounts of regular gifts add up to a fantastic start to adulthood or a financially secure future for your children or grandchildren.

And the best part of this is that, unlike sweating it out in the gym, making this change couldn’t be easier.

All you need to do is pick up the phone to your Fairstone adviser, pop them an email or fill in our form below.

It could be the best exercise you do this year or for many years to come. Now if you excuse me, I have an exercise bike with my name on it…

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

While the 2025 Budget packed less of a punch than many had feared, it still brought in some important changes.

Subtle adjustments to tax thresholds, allowances and rules can still have a meaningful impact — and without proper planning, they can quietly erode your financial position.

Here we look at some of the key changes that will take effect from the start of the 2026/27 tax year and what they may mean for you.

One of the biggest measures confirmed in the Budget is that personal income tax thresholds will remain frozen at their current levels until at least April 2031.

For England, Wales and Northern Ireland this is as follows:

| Band name | Taxable income threshold | Tax rate |

| Personal allowance | £12,570 | 0% |

| Basic Rate | £12,571 to £50,269 | 20% |

| Higher Rate | £50,270 to £125,139 | 40% |

| Additional Rate | £125,140 and above | 45% |

The Scottish Government sets its own rates and thresholds which are currently as follows:

| Band name | Taxable income threshold | Tax rate |

| Personal allowance | £12,570 | 0% |

| Starter Rate | £12,571 to £15,397 | 19% |

| Scottish Basic Rate | £15,398 to £27,491 | 20% |

| Intermediate Rate | £27,492 to £43,662 | 21% |

| Higher Rate | £43,663 to £75,000 | 42% |

| Advanced Rate | £75,001 to £125,140 | 45% |

| Top Rate | Over £125,140 | 48% |

In the UK outside Scotland, this freeze effectively increases tax revenues over time without changing headline rates.

As earnings rise with inflation, more taxpayers will be pulled into paying tax and into higher bands – a phenomenon known as ‘fiscal drag’.

Even without a direct increase in tax rates, many of us can expect:

This “stealth tax” effect is one of the most significant long-term revenue raisers in the Budget.

In addition to the threshold freeze, the Government has confirmed changes to tax rates on certain types of passive income:

The tax on interest and property income is due to rise by two percentage points across bands:

For those with investments or planning disposals:

This change effectively narrows the gap between CGT and income tax, particularly for entrepreneurs and business owners.

The Budget did not change the headline pension tax allowances or the lifetime limit, but there are important developments.

From 6 April 2029, the National Insurance relief on salary-sacrifice pension contributions will be capped at £2,000 per employee each year; above that level contributions will attract NICs.

This affects higher earners and those making larger salary sacrifice pension contributions.

It makes reviewing pension funding strategies all the more important in the coming years.

While the nil-rate bands and residence nil-rate band remain at their current levels until at least April 2031, there are ongoing reforms to reliefs.

Agricultural and Business Property Reliefs are being revised and will include caps on relief eligibility.

The 2024 Budget announced that defined contribution pension funds will from part of your estate for Inheritance Tax from April 2027 — something to monitor closely in your estate planning discussions.

Given the above changes, it’s worth considering the following proactive steps before the 2026/27 tax year begins:

With thresholds frozen, small income increases can have a larger tax impact.

Assess whether opportunities exist to time income or gains more tax-efficiently.

Utilise ISAs and pension allowances to shelter income and growth from rising effective tax burdens.

Consider whether holding dividends and interest-bearing assets in tax-efficient structures could reduce exposure to the higher passive tax rates.

With reliefs and nil-rate bands frozen and evolving, earlier planning can help mitigate future tax liabilities.

While the headline tax rates didn’t see the dramatic overhaul some anticipated, the Autumn 2025 Budget delivered significant changes that will affect many taxpayers.

The prolonged freeze on income tax thresholds, increased taxes on passive income, and tighter pension relief mechanics mean that careful planning is more valuable than ever.

We’re here to help you navigate these changes. For tailored advice on how the 2026/27 tax changes affect your personal finances, speak to one of our advisers today.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

| Match me to an adviser | Subscribe to receive updates |

The key changes include a continued freeze on income tax thresholds, higher dividend tax rates from April 2026, increased tax on savings and property income from April 2027, higher Capital Gains Tax on certain business disposals, and upcoming restrictions on National Insurance relief for pension salary sacrifice.

Fiscal drag occurs when tax thresholds remain frozen while wages rise with inflation.

As a result, more people pay income tax or move into higher tax bands, reducing take-home pay even though tax rates have not increased.

Yes. Even modest pay rises can push more of your income into higher tax bands.

Over time, this can significantly increase the amount of tax you pay without any change to headline tax rates.

From 6 April 2026:

These increases apply to dividends held outside tax-efficient wrappers such as ISAs and pensions.

From April 2027, tax on savings interest and property income will increase by two percentage points across all income tax bands.

This means more savers and landlords may see higher tax bills, particularly with thresholds frozen.

No. Income and gains within ISAs remain free from income tax and Capital Gains Tax.

With rising taxes on dividends, interest and capital gains, ISAs become even more valuable as a tax-efficient wrapper.

However, it is important to note that the 2025 Budget did change the amount that people can put in a cash ISA.

From April 2027, the cash ISA limit for under-65s drops from £20,000 per tax year to £12,000 per tax year.

The £20,000 limit for stocks and shares ISAs remains unchanged, as does the £20,000 cash ISA limit for those aged 65 and over.

From 6 April 2026, the lower Capital Gains Tax rate for Business Asset Disposal Relief and Investors’ Relief will increase to 18%.

Consequently, this reduces the tax advantage for entrepreneurs and business owners when selling qualifying assets.

While pension allowances remain unchanged, from April 2029 National Insurance relief on salary sacrifice pension contributions will be capped at £2,000 per employee per year.

Contributions above this level will attract NICs, affecting higher earners.

Inheritance Tax nil-rate bands remain frozen until at least April 2031.

However, Business Property Relief and Agricultural Property Relief are being reformed with new caps, and from April 2027 defined contribution pension funds will form part of your estate for IHT purposes.

Key steps include reviewing your income structure, maximising pension and ISA allowances, planning dividend and interest income more carefully, and reviewing estate and succession plans well ahead of time.

Given the cumulative impact of frozen thresholds, higher passive income taxes and pension changes, tailored financial advice can help reduce tax exposure and protect long-term wealth.

As a result. early planning is particularly important.

What is the outlook like for investors in the year ahead?

Here we take a look at some of the main themes, key markets and investment drivers for 2026 – and how these could affect your financial plans.

As we look ahead to 2026, several themes remain front of mind for investors including:

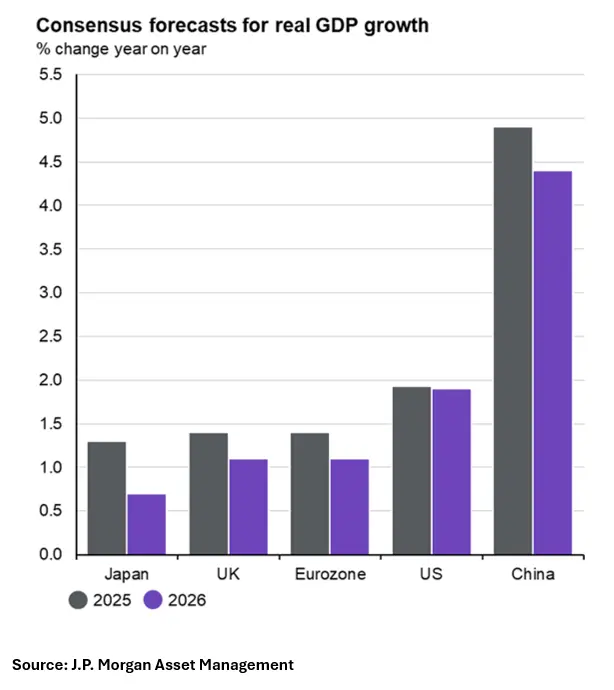

At a regional level, consensus expectations continue to favour the United States, where GDP growth is forecast to remain resilient, while Europe and other developed markets face more subdued prospects.

Emerging markets, meanwhile, are expected to benefit from more supportive duration dynamics, underpinned by a weaker US dollar.

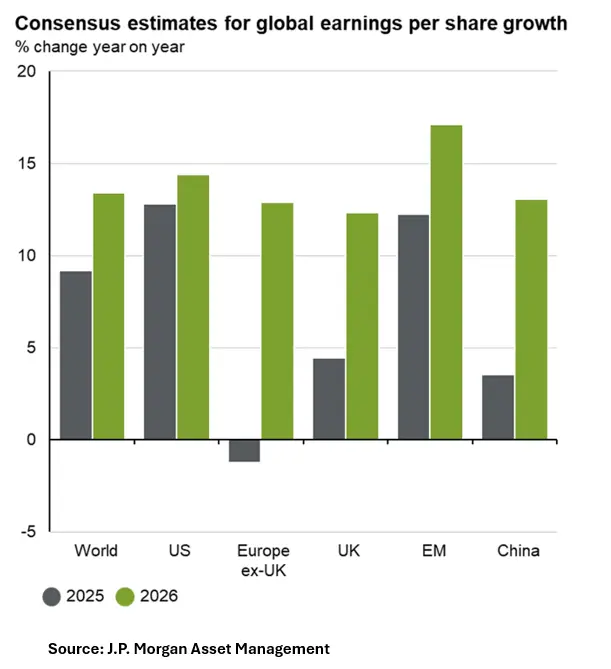

Despite the powerful rally in the “Magnificent Seven” technology stocks that dominated much of 2025, broader US equity market returns were comparatively subdued, lagging several other major regions as investors became increasingly alert to the risks of concentrated market leadership and elevated valuations.

Nevertheless, US GDP (Gross Domestic Product) growth has held up well and remains at the forefront of developed market growth expectations heading into 2026.

Corporate fundamentals continue to provide solid support, with more than 80% of S&P 500 companies beating earnings expectations in the third quarter, and forward guidance across both the technology sector and the wider market pointing to sustained profit growth.

Furthermore, corporate investment is expected to remain robust, underpinned by tax incentives and a more accommodative regulatory backdrop for the banking sector, which should support lending activity and credit growth.

While labour markets are showing signs of gradual cooling, productivity per worker continues to improve – a trend likely to persist as companies increasingly integrate Artificial Intelligence into business operations.

Against this backdrop, the Federal Reserve is widely expected to continue easing policy, albeit at a measured pace given lingering inflationary pressures. A steeper yield curve is therefore anticipated, creating a constructive environment for risk assets, particularly equities and high-quality corporate bonds.

Across Europe, equities demonstrated notable resilience through 2025, particularly in the latter months, supported by limited exposure to the most highly valued technology stocks and renewed strength across luxury goods, select industrials, and consumer-facing sectors.

While economic activity across the region remains subdued – most notably within Germany’s industrial sector, where output data continues to signal underlying weakness – stabilising energy prices and targeted fiscal stimulus have helped to cushion market returns.

The European Central Bank faces a challenging policy backdrop. Although inflation has continued to moderate, it remains above target, with easing core inflation offset by persistently elevated services inflation.

This dynamic complicates the outlook for monetary policy and suggests that any further easing is likely to be measured.

However, valuation differentials between European and US equities have continued to widen, presenting potential opportunities for selective investors.

Companies with strong balance sheets, durable cash flows, and pricing power may be well positioned to benefit as markets look beyond near-term growth challenges.

UK equities delivered mixed performance through 2025.

Large-cap stocks were relatively resilient, supported by steady global growth and strength across energy and materials, while mid- and small-cap equities lagged as persistent concerns over domestic growth, sticky inflation, and an uncertain fiscal backdrop weighed on sentiment.

The Bank of England has signalled an increasing openness to easing policy, which could help alleviate pressure on more interest-rate-sensitive areas of the market.

That said, the outlook remains finely balanced, with inflation proving stubborn and consumer confidence subdued.

As with our view across continental Europe, we believe a selective investment approach is well suited to the year ahead, focusing on companies with strong balance sheets, robust cash generation, and exposure to global growth drivers rather than relying solely on domestic demand.

Emerging markets face a mixed outlook. Continued US dollar weakness has supported positive earnings surprises, helping to underpin equity market performance through 2025.

However, renewed concerns around the pace of China’s recovery, alongside heightened volatility in technology-exposed markets such as South Korea and Taiwan, remain notable headwinds moving forward.

In China, fiscal stimulus is expected to provide a degree of economic stability, though policymakers appear focused on maintaining balance rather than driving aggressive expansion. This more measured approach may weigh on regional GDP growth expectations as the year progresses.

Overall, continued US dollar weakness should continue creating more favourable duration dynamics and support earnings growth across emerging markets, benefiting both equity and fixed income assets.

While markets with significant exposure to the global technology cycle may remain more volatile, we view the broader emerging market outlook as constructive.

Japanese equities have moderated following several months of strong gains, which were underpinned by ongoing corporate governance reforms and a persistently competitive yen.

Toward the end of 2025, however, rising inflationary pressures and a flare-up in geopolitical tensions between Japan and China contributed to a more cautious, risk-off tone across the market.

Despite this near-term pause, the structural tailwinds supporting Japan remain firmly in place.

Continued improvements in corporate governance and a stronger focus on shareholder returns provide a constructive long-term backdrop, although we remain mindful that both domestic developments and external geopolitical factors may continue to drive bouts of volatility.

Moderating interest rates and resilient corporate fundamentals provided a supportive backdrop for fixed income markets throughout 2025, a theme that we expect to carry into the year ahead.

Bond yields are anticipated to trend lower in 2026, offering an important tailwind for risk assets more broadly.

Softer inflation readings across the US, eurozone, and UK have underpinned rallies in sovereign bonds, as central banks have shifted policy rates lower, with guidance from both the Federal Reserve and the Bank of England signalling further easing ahead.

At a global level, corporate bonds are well positioned to continue outperforming government bonds, supported by strong balance sheets and contained default expectations.

While credit spreads may tighten further, gains are likely to be more incremental, with investors remaining selective amid an uneven and evolving macroeconomic landscape.

Overall, fixed income markets are expected to provide a valuable counterbalance to equity risk, with high-quality bonds retaining a key role as both a source of steady income and a stabilising force within multi-asset portfolios.

While artificial intelligence (AI) stocks have experienced a remarkable rally throughout 2025 – raising concerns of an AI-driven bubble – AI remains a genuine structural growth theme, supporting productivity gains and driving leadership across global markets.

Adoption is set to accelerate further, with substantial investment in technology and infrastructure continuing across both developed and emerging markets, generating ripple effects in labour markets.

Although concentration risk and elevated valuations are considerations, the major AI players continue to deliver strong revenue and margin growth, leaving many investors confident in the potential for continued upside.

However, AI is unlikely to be the sole driver of market returns in 2026.

Quality stocks – those with a history of stable earnings, high profitability, and low leverage – are expected to reassert their role in protecting portfolios during periods of volatility, while sectors such as pharmaceuticals, financials, and industrials appear particularly attractive, offering more modest valuations alongside steady earnings growth.

The global growth narrative for 2026 is evolving in a way that underscores regional divergence.

While the US and China are expected to deliver above-trend growth, Europe and other developed markets remain constrained by structural headwinds, including muted domestic demand and competitive export pressures.

Emerging markets, by contrast, stand to benefit from a combination of policy flexibility, supportive demographics, and a weaker US dollar.

This uneven backdrop creates both opportunities and risks, emphasising the importance of active asset allocation and a focus on both sectoral and regional diversification to capture growth potential while managing volatility.

Although inflation has moderated from its peaks, the path ahead remains complex.

Central banks are expected to maintain a cautious stance, balancing the need to support growth with the imperative to contain residual inflationary pressures.

In the US, the Federal Reserve is likely to continue cutting rates, but not aggressively, as policymakers remain wary of reigniting price pressures.

In the UK, rate cuts may be slower and more conditional, given persistent inflation.

For investors, this environment favours active selection across bond markets, while maintaining hedges against inflation through real assets and commodities.

The interplay between disinflation trends and policy caution will be a defining feature of fixed income markets in 2026.

We think 2026 offers opportunities for investors willing to navigate complexity.

Consensus supports risk assets, but divergences in regional and thematic views underscore the importance of active management and diversification.

Consulting a financial adviser can help you decide what investments could help you towards your financial goals in 2026, whether that’s accumulating funds for retirement or investing for growth.

To start your investment journey – or if you’re thinking of changing course – talk to an adviser today.

| Match me to an adviser | Subscribe to receive updates |

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

I work with many business owners who are trying to balance running their company with planning for their own financial future.

The upcoming dividend tax changes are a reminder that what worked last year might not be the best approach going forward.

Taking time now to review how you pay yourself can help you make smart decisions that protect both your business and your personal finances.

The start of a new year is a great time to take stock. For small and medium-sized business owners, the way you take income can have a big impact on your tax bill and your long-term wealth.

With dividend tax rates set to rise from April 2026 and income tax thresholds still frozen, planning ahead is more important than ever.

In the Autumn Budget, the Chancellor announced that dividend tax rates will rise by 2% from April 2026:

For many SME owners who take most of their income as dividends, this is a big change.

Dividends are paid from profits that may have already been taxed at up to 25% Corporation Tax.

This extra increase adds more pressure at a time when costs are rising, and tax thresholds remain frozen.

The overall tax burden for business owners is high. If you rely on dividends as your main source of income, these changes could reduce your take-home pay and affect your ability to save for the future.

Planning ahead gives you more flexibility to adapt before the new rates take effect.

Reassess the balance between salary and dividends.

A modest salary can help maintain pension contributions and National Insurance credits, while dividends can remain tax-efficient up to certain thresholds.

Pensions remain one of the most effective ways to extract profits from your business tax-efficiently.

Employer contributions can reduce Corporation Tax and build long-term wealth.

Consider options such as:

You should look at provisions including:

Tax planning for business owners often needs a joined-up approach.

Working closely with both a tax adviser and a financial planner ensures you’re not only compliant but also making the most of every opportunity to reduce tax and grow wealth.

Accountants can help with the technical aspects of remuneration and compliance, while financial planners focus on the bigger picture: your lifestyle goals, retirement plans and family security.

The end of the 2025/26 tax year is only a few months away. Early planning means you can take advantage of current allowances and avoid last-minute decisions that may not be optimal.

I see first-hand how easy it is for business owners to put their own planning on the back burner.

Small and mid-sized businesses are the backbone of the UK economy, but the environment is becoming tougher for those taking the risk to grow and employ.

Reviewing your remuneration strategy now can help you stay ahead of upcoming changes and protect your financial future.

If you’re a business owner unsure of where the new dividend taxation regime leaves you, now is the time to act.

Book a confidential consultation and we can help you review your remuneration strategy and ensure you’re extracting profits in the most tax-efficient way for both your business and personal finances.

| Match me to an adviser | Subscribe to receive updates |

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax treatment depends on individual circumstances and may change. The value of investments can go down as well as up and you may not get back the full amount you invested. Past performance is also not a reliable indicator of future performance. Always seek professional advice before making financial decisions.

The Financial Services Compensation Scheme (FSCS) has raised its deposit protection limit from £85,000 to £120,000.

This means that if you hold deposits or savings with a UK-authorised bank, building society or credit union which goes out of business, FSCS will compensate you up to £120,000 per person, per authorised firm.

If you have an account under joint names, you have up to £240,000 of your deposits protected, providing you do not have an individual account at the same institution as their joint account.

In addition to this change – which will cover balances on a permanent basis – the FSCS has also announced an increase in the protection given for temporary high balances.

The FSCS will now cover temporary high balances – such as the proceeds of a house sale or an inheritance – up to the sum of £1.4m, instead of the previous limit of £1m.

Such an amount will be protected for up to six months after the date at which the sum is deposited.

The previous deposit compensation limit of £85,000 was established at the start of 2017.

Under the Deposit Guarantee Scheme Regulations 2015, the Prudential Regulation Authority (PRA) must review the FSCS deposit compensation limit periodically and at least every five years.

The PRA consulted on a proposed increase to the deposit compensation limit in March 2025 and confirmed its final rules in November 2025.

The new limit takes into account rises in inflation over the past eight years.

Investments are protected by the FSCS at £85,000 per person, per UK-regulated institution.

However, this limit will not be increasing in line with the limit for savings institutions and will stay at £85,000.

Only banks, building societies and credit unions recognised by the FSCS are covered by the scheme and attract the new higher level of cover.

This information should be prominently displayed on institutions’ websites and in marketing materials.

A new logo indicating protection by FSCS has also been introduced and is below:

You can also check whether a bank or savings provider is covered by the scheme by using the FSCS online tool.

While the new deposit limit will help many savers, it will not cover amounts over £120,000 in one individual account.

In such cases, to ensure that all your savings are covered, you should consider dividing the money into more than one account in more than one eligible institution.

One straightforward way of doing this is via a cash management platform, such as that offered by providers including Insignis and Raisin.

A cash management platform allows multiple accounts with multiple providers to be managed via a single platform and single log-in.

Providing the savings institutions are recognised and you don’t put in more than £120,000 into one account, all your savings will be protected by the FSCS deposit protection scheme.

The FSCS deposit protection scheme offers important peace of mind for savers. The extension of its limit to £120,000 expands the maximum cash protected by more than 40%.

However, account holders with such sums in standard savings accounts will pay tax on interest earned over £1,000 in any financial year.

The purchasing power of your money is also likely to be eroded by the effects of inflation.

Talking to a financial adviser could help you consider other options to make more of your money, including ISAs and other tax-efficient investments.

To get more information on how to make your savings work harder for you, get in touch today.

| Match me to an adviser | Subscribe to receive updates |