Market Updates

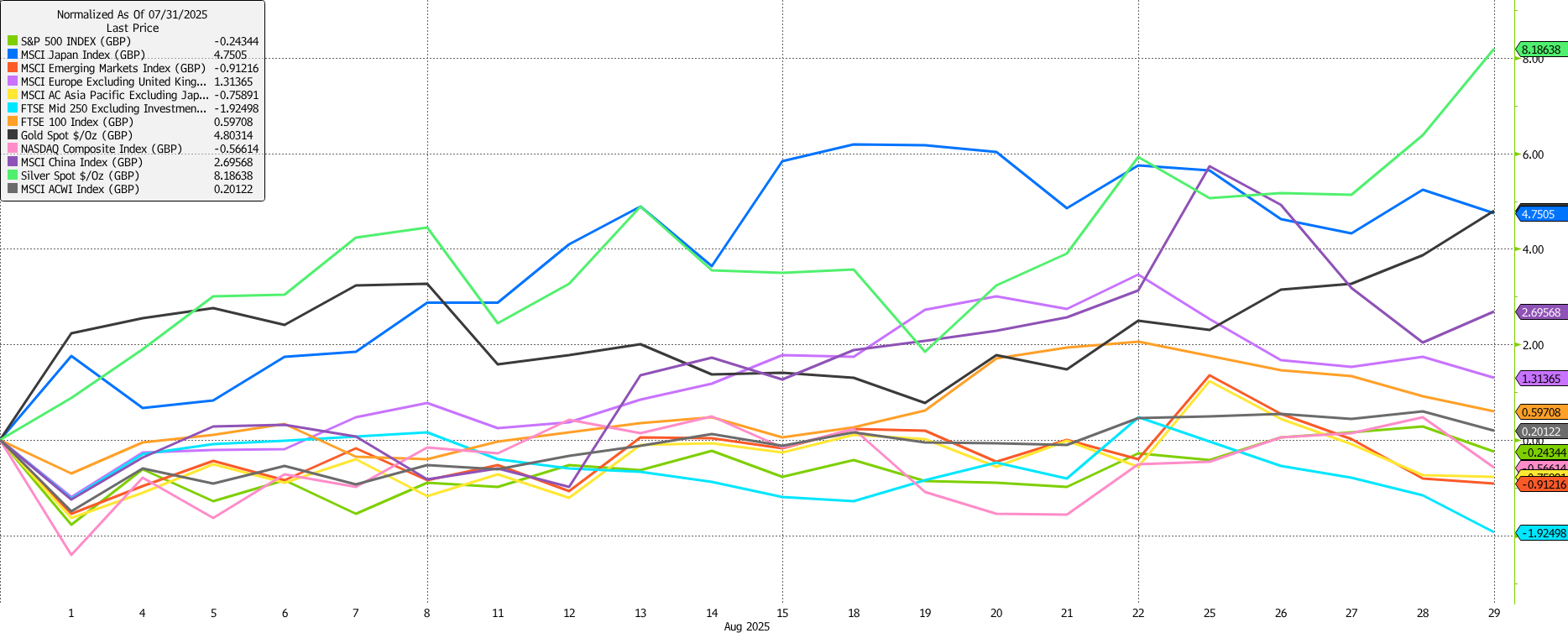

August delivered a mixed but generally resilient performance across global markets. Equities absorbed tariff headlines and political noise to post modest gains overall, though leadership rotated meaningfully. Japan outperformed, rising around 4.8% in GBP terms, supported by a weaker yen and tariff relief for automakers. In contrast, UK equities lagged, with the FTSE 250 down nearly 2% amid domestic policy uncertainty, a surprise inflation uptick, and renewed speculation over potential government revenue-raising measures.

Continental Europe eked out a small gain (1.3%) but lost momentum into month-end as French political risk resurfaced following the Prime Minister’s surprising announcement of a confidence vote on 8th September. Given the administration’s lack of support in parliament, he’s likely to lose the vote which means President Macron will then have three options: call for a new parliamentary election; ask the PM to stay in charge of a caretaker government; or nominate a new prime minister. The last option is probably the most likely and would just about keep the plates spinning, but would likely stymie the deficit reduction plans for 2026 and continue to put pressure on the French bond market.

Precious metals were standout performers this month standout. Gold tested new highs near $3,500/oz, and silver broke $40/oz for the first time since 2012, reflecting a combination of policy uncertainty, softer late-month US dollar tone, and demand for hedges.

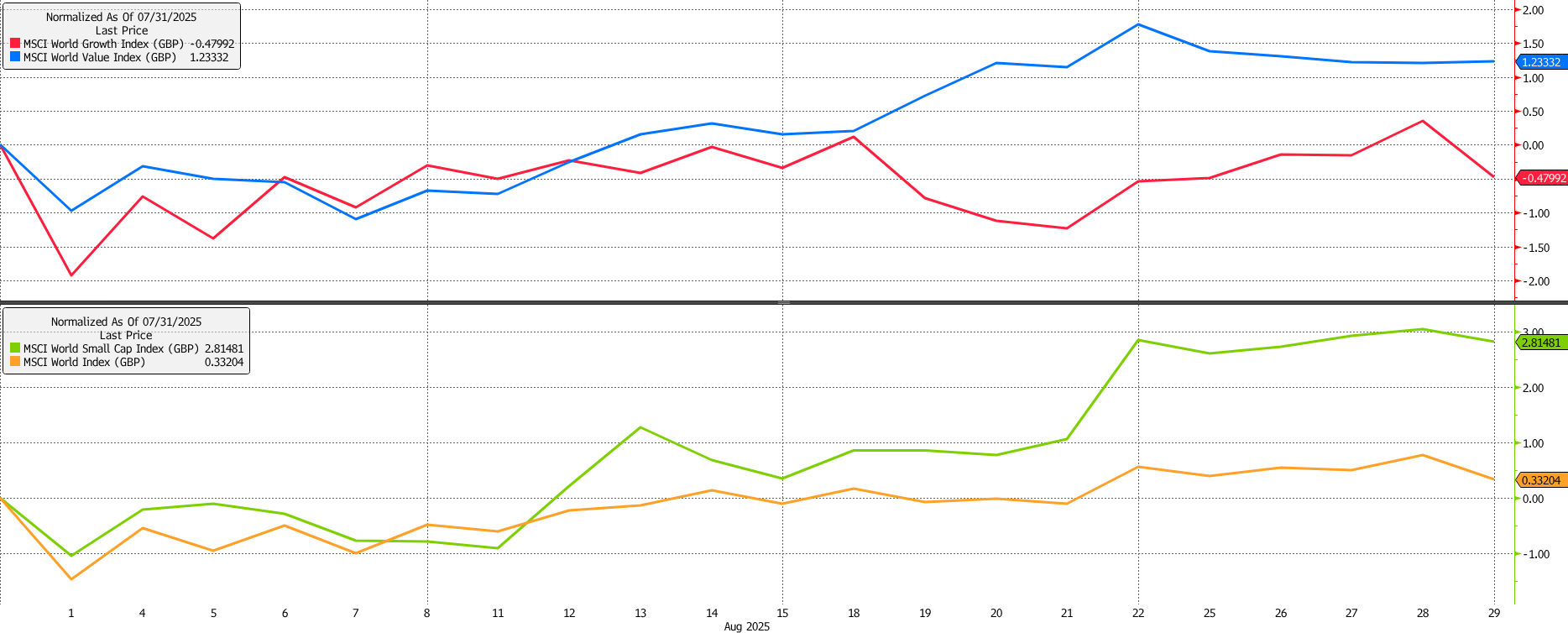

Style and size factors diverged: value outperformed growth, aided by higher long-dated government bond yields and general sector composition, while small caps rallied on expectations of earlier US Federal Reserve easing following Chairman Jerome Powell’s Jackson Hole Symposium remarks. Mega-cap growth names faced idiosyncratic pressure; most notably NVIDIA, where strong absolute results were overshadowed by slowing growth rates and potential tariff-related headwinds.

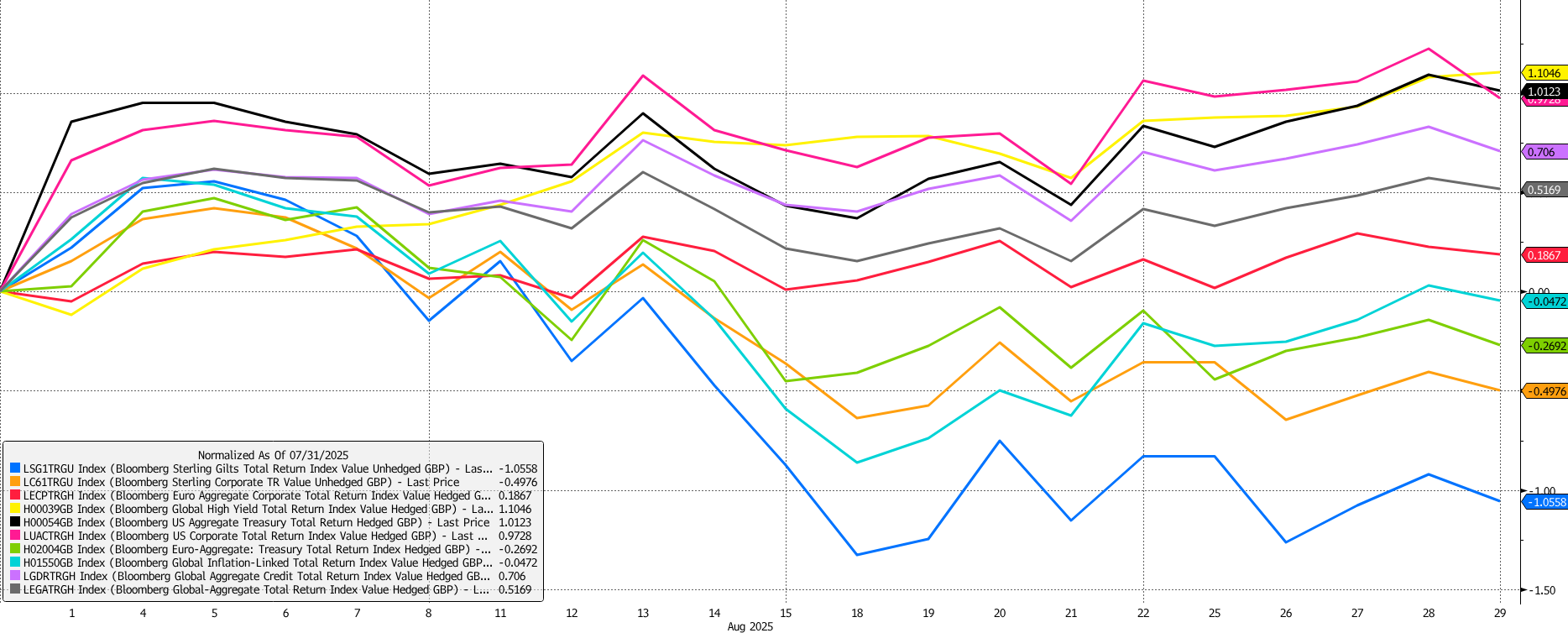

In fixed income, US Treasuries posted positive returns (1%) as yields dropped on dovish Fed signals, while global high yield bonds were once again the best performers, benefitting from their risk-on link to equities and gaining 1.1% on continued spread compression.

Gilts were a notable underperformer, falling by 1.1% as particularly longer maturity yields rose. 30-year Gilt yields reached 5.6%; their highest since the late 1990s.

In the US, as noted above, Jerome Powell’s Jackson Hole speech really moved the dial as he heavily implied that a rate cut is coming in September, while placing more emphasis than before on the relative weakness of the labour market. Meanwhile, the threat of tariffs disruption remains a spectral presence in markets; the announced, trade weighted rate is now north of 18%—a 1930s style headline—but duties actually paid are still catching up. This means that some of the growth and price impacts are likely still ahead, not behind us. Even so, baseline US growth expectations haven’t fallen, which helps explain why risk assets have remained resilient.

We saw a different narrative unfold in the UK. The Bank of England cut interest rates by 0.25% to 4.0%, but the vote passed on a knife edge, and the tone of the Monetary Policy Committee’s comments were hawkish enough to keep a lid on bond market enthusiasm.

The overall environment remains moderately supportive, but uncertainty is elevated. Growth is steady in most regions, inflation is stable if still above targets, and central banks are still on balance signalling a shift toward lower rates. However, policy decisions will remain data‑dependent, and political developments—covering trade policy, fiscal pressures, and governance—could influence market sentiment. We expect conditions to remain broadly constructive, but risks are meaningful; careful monitoring of economic indicators and policy signals will be important in the months ahead.

For a deeper dive into August’s market performance, listen to our Market Update podcast as Portfolio Manager, Harry Scargill, and Investment Director, Oliver Stone, CFA, break down the major movements and developments.

We have over 1250 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Our advisers |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.