Market Updates

Summary

February was dominated by news of Vladimir Putin’s deranged invasion of Ukraine. As we previously wrote, Russian forces attacked cities across the country overnight on 24th February, with little let up in fighting since. Other macroeconomic events naturally paled.

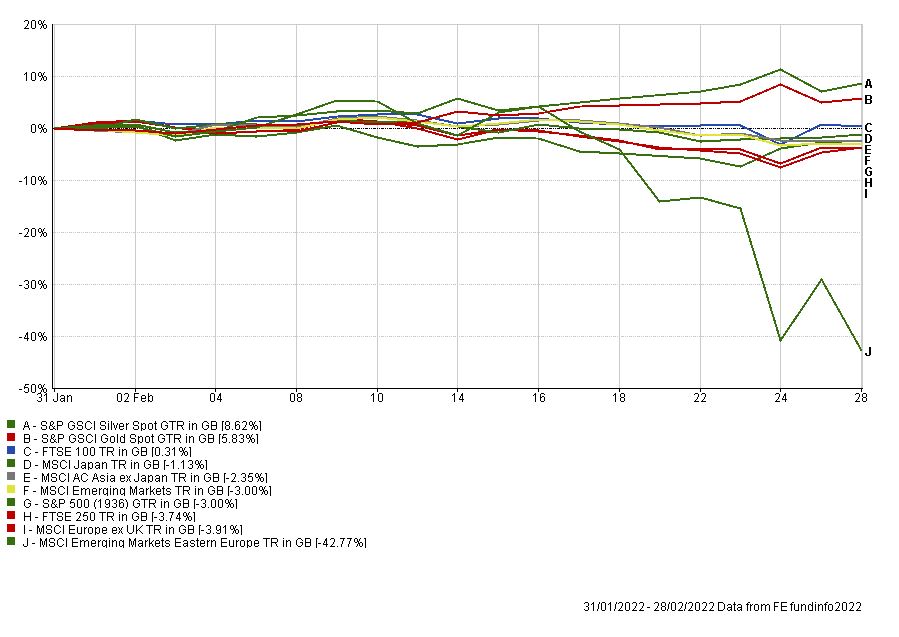

For the month as a whole, most equity regions fell in pound terms, with the FTSE 100 performing best, eking out a small positive return. Other regions were arranged behind, generating varying levels of negative returns, with European equities understandably worst hit with a 3.9% drop.

Safe havens performed well, with developed market government bonds retracing some of their year-to-date losses, and precious metals in the form of gold and silver moving sharply higher as the chart below shows.

The chart below also shows the stunning collapse in Russian equities through February as illustrated by the MSCI EM Eastern Europe Index that Russia dominates (c.61%). Almost all of those losses came in the last three weeks as the Moscow Exchange has shuttered with no immediate plans to reopen.

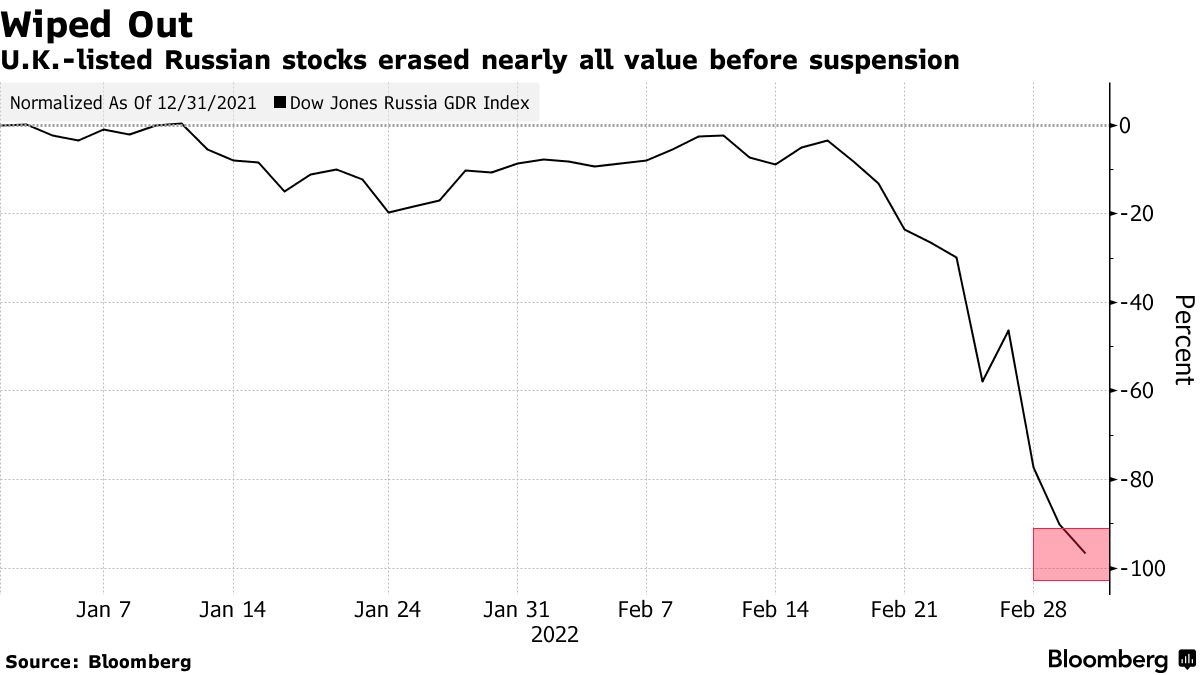

Russian stocks listed in London erased more than 90% of their value before being suspended as the second chart below shows, while global index providers announced plans to remove the nation’s shares from their indices and European companies with business exposure to the country lost more than $100bn in market value:

The Russian ruble has fallen by 23% in the last week alone versus the US dollar, while Russian government and corporate bonds have also collapsed, with ripple effects felt across financial markets.

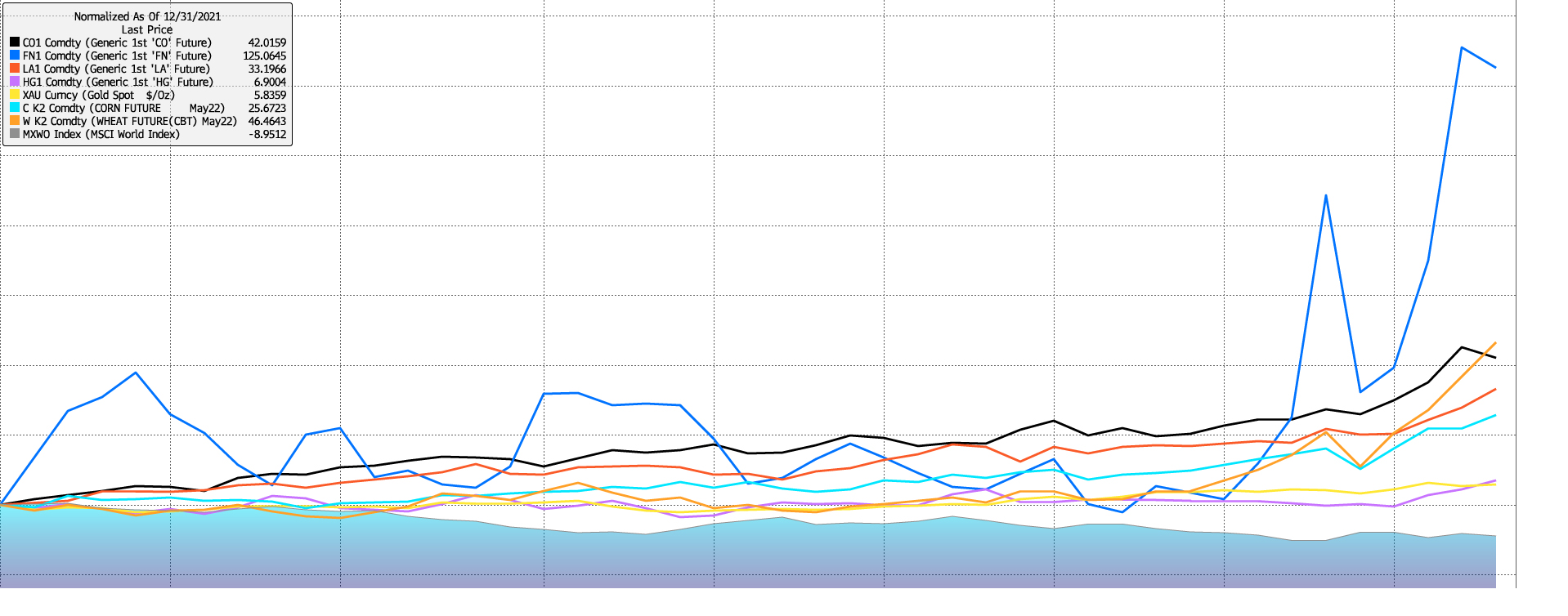

The most notable impacts have been seen in the commodities complex with the price of oil reaching levels not seen in 10 years and natural gas prices scaling previous unfathomable heights (oil denoted by ‘CO1’ and gas by ‘FN1’ in the chart below). Prices of agricultural and industrial commodities have also risen sharply, with those of corn and wheat 25.6% and 46.6% higher respectively, and those of aluminium (‘LA1’) and copper (‘HG1’) 33.2% and 6.9% higher respectively; all since the start of the year.

To highlight the magnitude of these gains, the MSCI World equity index is also included in this chart (shaded blue), with this gauge having fallen by nearly 9% over the same time period in US dollar terms:

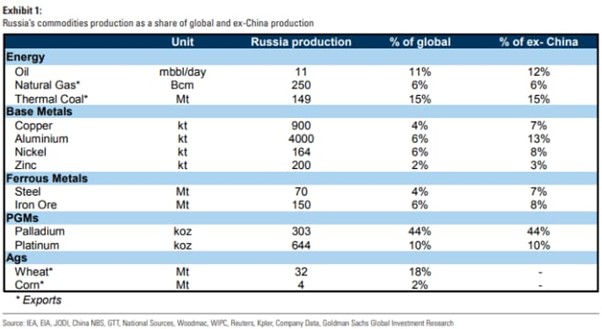

Russia, along with Ukraine, is a major producer of many crucial commodities as the table below shows, with these recent price rises commensurate with the potential disruption and uncertainty that may now follow should a resolution not be quickly achieved:

As we also wrote last month, sanctions were immediately imposed by the US, EU and UK, amongst other nations; initially on individuals and some banks, but now encompassing a wide spectrum of entities including the Russian central bank, whose foreign exchange assets have been frozen to the tune of hundreds of billions of dollars, impeding efforts to fund the war and keep the ruble under control. In addition, many western businesses have taken dramatic steps to cut off all ties with Russia across a vast swathe of sectors, from media and entertainment, to consumer goods and heavy industry.

While sanctions imposed in previous years seemed to be shaken off without much fuss, the speed and severity of what has been enacted here, along with their decisiveness and unity of implementation has caught many commentators wholly by surprise, not least the notion that western countries are prepared to sacrifice some comforts to try to stop Putin.

While Russian oil and gas imports have not been officially banned yet (though at the time of writing we note that this is now being actively discussed by the US government), we have observed that Russian crude oil is being shunned by market participants engaged in what is being termed ‘self-sanctioning’. Because of confusion around what is legally permitted, fears of reputational damage or moral objections, banks are disinclined to provide trade financing and tanker companies are reluctant to ship Russian oil, with the squeeze starting to have the same effect as an embargo. While undoubtedly bad for Russia, given their importance in global oil production, this could leave a big hole in the market.

Russian gas exports may be harder to ban or replace, unofficially or not. Infrastructure requirements are much more complex and difficult to replicate in the short term, with Europe relying on Gazprom for roughly one third of all gas it consumes.

Looking ahead, frustratingly there is little of certainty that can be said about this incredibly sad situation. Talks of some description are ongoing between the two sides though without any announcements of note, and for now we must hope for better headlines in the days to come.

Looking at financial markets, uncertainty will reign until said better headlines appear, with high levels of volatility likely to persist and further sharp moves in global commodities markets to be expected. In this environment, safe havens are more likely to outperform, along with ‘real’ assets linked in some way to inflation or inflation expectations – in this case particularly commodities. As always this speaks to the importance of diversification across portfolios.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

Sign up to our Intelligent Wealth newsletter to receive the latest industry news, articles and updates directly in your inbox.

Sign up to Intelligent Wealth

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Match me to an adviserFor further information, please contact:

For further information, please contact: