Market Updates

February started where January left off; with strongly rising global stock and bond markets carrying on the positive sentiment shift we saw at the start of the year. Unfortunately, this status quo was not to last, with prices rapidly cooling across the board as the month rolled on.

As we wrote last month, markets were buoyed in January by softer inflation data, but also – and arguably more importantly – by expectations that the trend of falling inflation rates would continue, and, along with it as a direct consequence, so global monetary policy tightening cycles would come to an end, and perhaps even start to reverse later this year.

Perhaps counterintuitively, one of the conditions for this rosier scenario to unfold is weaker economic data – weaker data prints allow investors to reasonably expect inflation to continue to slow, and with it interest rate rises to halt or reverse. Why should this be good news for risk assets? Financial markets are forward looking, with the idea being that they can ‘look through’ weakness to foresee the eventual recovery.

February, however, saw a reversal of this trend across regions to a greater or lesser extent, with resilient economic data in the form of GDP growth, jobs added, and business sentiment indicators, leading investors to reassess their expectations for both the peak in interest rates, and the subsequent pace of any rate cuts, as the road back to central bank inflation targets could be longer than previously hoped.

In short, ‘good’ economic news turned out to be ‘bad’ news for financial markets, with central bankers making it clear in comments throughout the month that despite recent declines, inflation remains too high, and their job of bringing it under control is not yet done.

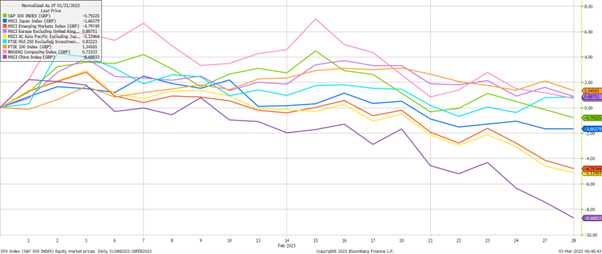

Turning to equities first, the first chart below shows the performance of various major regional indices in pound terms, in February. The initial rise at the start of the month is clearly visible, before a steady decline takes hold, with most indices ending the month very slightly positive or firmly negative. What gains remained by the close of play were led by developed markets; most notably the UK where again, the FTSE 100 topped the table with a 1.35% rise. European equities also eked out a gain of 0.89%, but was one of the regions affected by a change in inflation and interest rate expectations.

At the other end of the spectrum, Chinese equities were hardest hit, falling by 8.69%, with associated Asian and Emerging Market indices also falling in sympathy. Geopolitical tensions drove some profit taking here over the month, but Chinese equities in particular still look cheap on a relative and absolute basis, while the post-Covid reopening process continues apace:

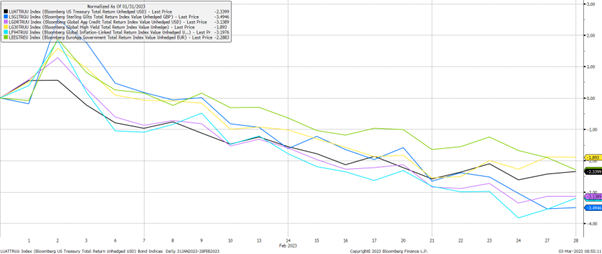

In bonds, we saw a similar story as in equities, with the second chart below showing a rise at the start of the month, followed by a persistent decline. Bond prices generally struggled as investors priced in a ‘higher for longer’ interest rate environment as outlined above, with UK Gilts struggling especially; falling by 3.49%:

The UK remains much-maligned by global investors, with outflows from UK equity-focused funds remaining persistent through 2022 despite the strong outperformance of the FTSE 100. But, along with other developed market countries we have seen some resilience in recent domestic data releases, pointing towards a more stable economic backdrop for now.

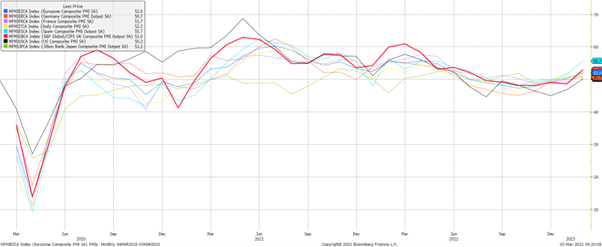

In fact, as the final chart below shows, sentiment surveys looking at manufacturing and services businesses across a wide spectrum of sectors currently shows the UK as one of the stronger economies (the thick red line); behind only Spain. When looking at this chart, the construction of these indices means that a score above 50 indicates growth, while one below 50 indicates contraction:

To conclude in a similar vein to last month, while the macroeconomic backdrop for growth now looks rosier, counterintuitively this raises the downside risk that inflation proves to be more stubborn, and central banks’ monetary policy needs to be tighter to combat it.

We could see further volatility due to the ongoing uncertainty around the trajectory of inflation and interest rates, though the silver lining there is that equities and bonds remain cheaper than this time last year, meaning market may be less vulnerable to the myriad of risks in the ether.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.