Market Updates

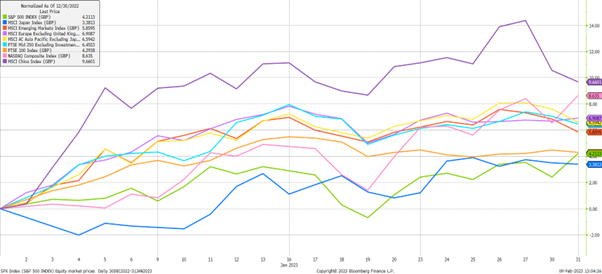

Equity markets were buoyed by a number of factors; perhaps most notably the ongoing Chinese covid reopening narrative, which led to another extremely strong month for the MSCI China Index, which rose by 9.66% in pound terms as per the first chart below:

After a capitulation bottom in October following the end of the Communist Party Congress, and amidst calls that the country was ‘uninvestable’, Chinese equities staged a powerful recovery, rising by nearly 40%. The surprisingly rapid end to their zero-covid policies has raised expectations that the Chinese economy will experience a strong recovery in 2023, which should benefit both China and its trading partners in the region and further afield.

Similar to European and US covid reopenings, there is a considerable amount of excess savings and pent-up consumer demand in China due to the numerous lockdowns imposed since 2020. Mobility indicators across a range of different sectors such as traffic congestion, flights taken, and fuel demand have moved meaningfully higher over the past couple of months.

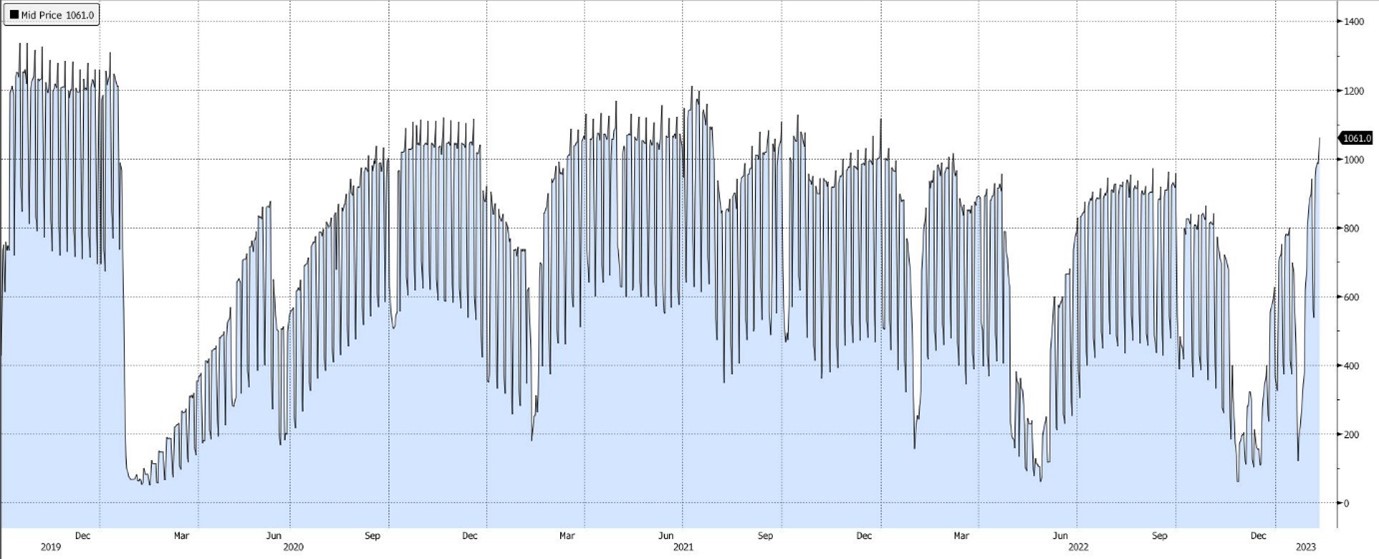

To give one example, the second chart below shows the number of people using Beijing’s metro each day, over the last 4 years; this measure has risen to a 1-year high of nearly 1m people, with room to move higher relative to previous years:

This has certainly been a positive influence on market prices in recent weeks, but such a large increase in demand does also raise questions about the possibility of another inflationary impulse; just at a time when western central banks are cautiously easing off on interest rate rises and thinking they’ve won their battle against price rises.

For now, the market’s consensus is that rates of inflation will continue to steadily decrease through 2023 and into 2024, and with that, so should interest rate hiking cycles come to a halt and perhaps even start to reverse. There are considerable risks to this view, which is also now forecasted to be accompanied by nothing more than a mild recession; if any recession at all. Should this eventuality come to pass, consumers would get some much needed relief from the very high levels of price rises seen over the last year, including those related to mortgage costs.

One of the areas already much more positively positioned in this regard is energy prices, which have fallen precipitously in recent months as consumers and businesses have reduced their demand, and (in Europe particularly) the weather has been unseasonably warm. At the end of January, gas storage in Europe was nearly 75% full, compared to just 35% at the same time a year ago. Further, the average purchase price for natural gas in January was more than 50% lower than the average price in the second half of 2022.

Going forward, a more balanced picture for energy prices would mitigate both consumers’ and governments’ squeezed purchasing power.

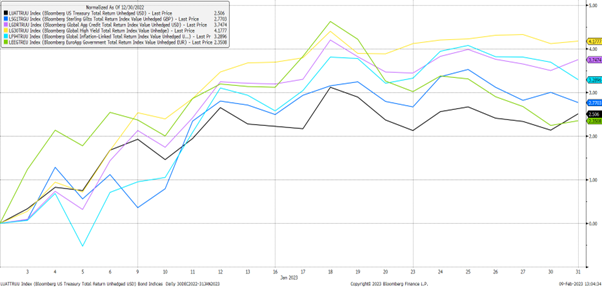

With this improved January sentiment also came a better month for bonds as the third chart below shows. This was most welcome after 2022 ranked amongst the worst ever years for fixed income investing.

We saw broad-based gains across the major asset classes, as market hopes for an end to central bank rate hiking cycles were raised as inflation readings in the US and Europe slowed:

Again, there are risks to this rosier view – should we see an upwards change in inflation and/or interest rate expectations, then we would expect volatility to quickly return to bond markets.

So, while the macroeconomic backdrop for growth now looks rosier, counterintuitively this raises the downside risk that inflation proves to be more stubborn, and central banks’ monetary policy needs to be tighter to combat it.

Regardless, the range of potential outcomes looking ahead is, unsurprisingly, extremely wide; our sense is that there will be substantial opportunities as we move through the year, but as always, the importance of diversification across portfolios cannot be overstated.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.