Market Updates

Equity and bond returns swung back into negative territory through June as uncertainty around Ukraine continued to weigh on sentiment. In addition, investors voiced increasing concerns around rapidly tightening global monetary policy, high inflation and historic lows in consumer confidence surveys.

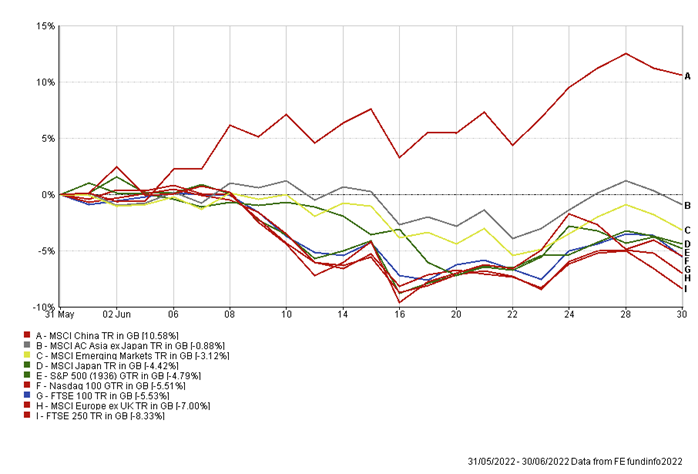

As the first chart below shows, developed market equities in particular struggled, with the large-cap European, Japanese and US indices falling by 7.0%, 4.4% and 4.8% respectively in pound terms. UK equities struggled this month; the FTSE 100 index lost 5.5% and the mid-cap FTSE 250 8.3%, affected by its more domestically focused composition:

Asian and broader Emerging Market equities were relative outperformers over the month, boosted by extremely strong performance from Chinese stocks which rose by 10.6% over the month (chart). These outsized gains come as a welcome relief to the weakness seen earlier in the year as numerous major cities suffered through Covid lockdowns. At one point in March 2022, the MSCI China index was down by nearly 30% in pound terms – it has subsequently recovered to be down just 0.5%.

Investors’ confidence in Chinese equities has been severely tested over the last year. Growth in China has deteriorated due to the Government’s zero-Covid policy, regulatory crackdowns across a swathe of diverse industries and weakness in the real estate sector.

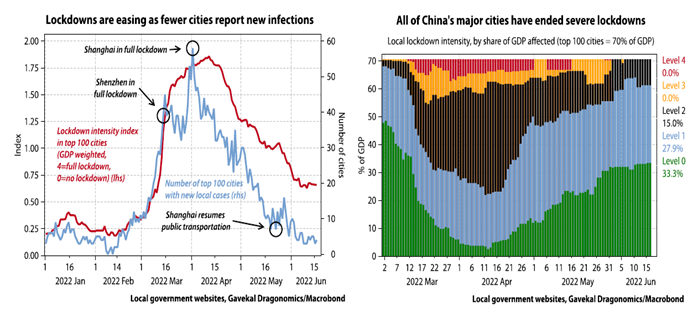

While restrictive Covid policy remains a risk, for now at least the picture has calmed, with the charts below showing that lockdown ‘intensity’ has significantly receded in recent weeks as new infections have fallen.

Importantly, the chart on the right shows that no cities are currently under the harshest Level 3 or 4 lockdowns as imposed on Shanghai earlier in the year:

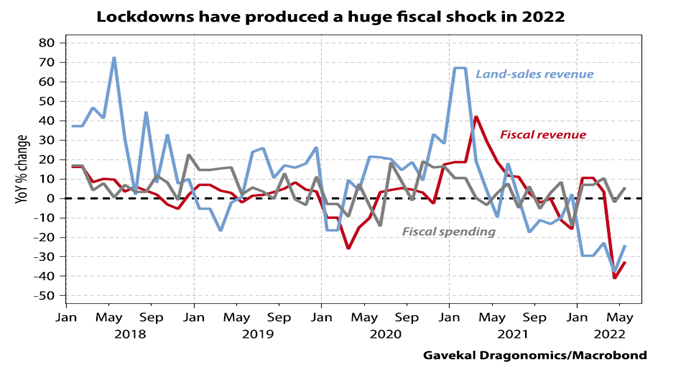

Additionally, it now seems that the Chinese authorities are ramping up fiscal and monetary stimulus after an initially lacklustre response. Extremely weak labour market data as a direct result of lockdowns has bled into consumer spending numbers, the impact of which has been a huge fiscal shock as tax revenue has plummeted per the chart blow.

In response to this, various fiscal and monetary measures are being enacted to boost growth through the remainder of 2022 and 2023. This presents an interesting counter-cyclical opportunity for investors relative to developed markets, which in general are only just beginning their respective slowdowns:

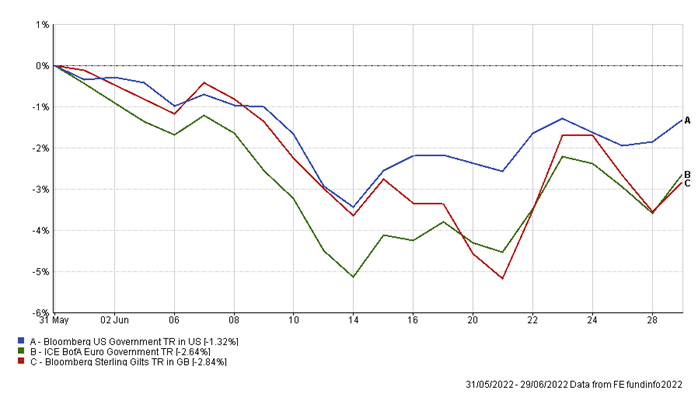

Developed market government bonds suffered another month of negative outturns as illustrated below. UK Gilts fared worse realtive to US and European counterparts, but the performance differential was much narrower than last month, with something of a recovery in prices being seen from mid-month onwards.

The US Federal Reserve remains committed to bringing inflation down, raising rates by 0.75% in June and expected to do similar in July. The Bank of England also raised rates by 0.25% to 1.25%, again citing the delicate balance between inflation management and economic growth.

The European Central Bank remains stuck at rock bottom levels, though has guided towards a first rate hike in July. Again, the ECB is stuck between a rock and hard place, with the rate of inflation still increasing month-on-month and ahead of expectations, reaching 8.6% in June, while the fragility of individual nations’ debt pictures is still very much apparent.

After a tough first half of 2022, July will be pivotal for the future direction of markets amid corporate earnings data, key inflation numbers and further central bank meetings. Should we see surprises to expectations, we would expect volatility to persist. As always, this speaks to the importance of diversification within portfolios.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

For further information, please contact:

For further information, please contact: