Market Updates

November started on a relatively positive note for risk assets as the Bank of England (BoE) declined to raise rates from the current record low of 0.1%, despite strongly hinting that they would do so. UK inflation is forecasted to reach a peak of 5% next year in conjunction with the next step up in the energy price cap, but the BoE cited ongoing uncertainties around labour market strength and consumer confidence in voting to not hike by a margin of 7-2.

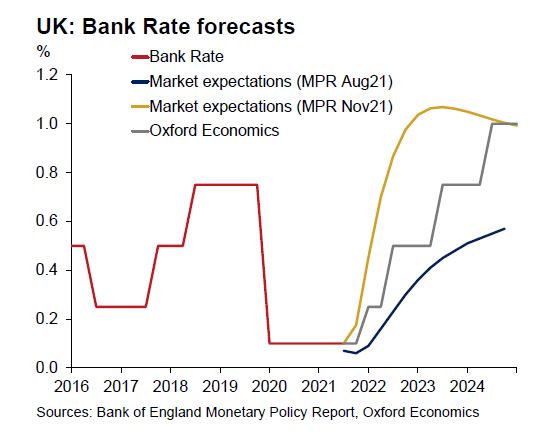

While the first rate hike is still expected relatively soon, the BoE indicated in its meeting minutes that the market’s current perception of the pathway for hikes is too aggressive, and particularly with Covid worries resurfacing, it may be 2022 before we see a move. The chart below illustrates this, showing the market’s current trajectory for rate hikes as being very aggressive (yellow line) versus Oxford Economics’ more benign forecast (grey line):

Elsewhere, the US Federal Reserve (Fed) struck a decidedly more hawkish tone through November which was one of the primary drivers of volatility through the month. Chair Jerome Powell was selected for a second term by President Biden after a period of deliberation – a continuity decision which equity markets initially welcomed – but then wasted no time in warning against high levels of US inflation and indicated that the Fed’s quantitative easing (QE) taper could be markedly accelerated, despite only being formally announced very recently.

At the beginning of November plans were announced to slow the QE buying program by $15bn per month to zero in June 2022, but in his comments before the Senate Banking Committee, Powell noted that it would be appropriate for the Fed to discuss an earlier end to the plan by ‘a few months’, indicating that the rate of slowdown could be doubled. Powell also chose this moment to opine on inflation, saying that the word ‘transitory’ should be retired when describing current conditions.

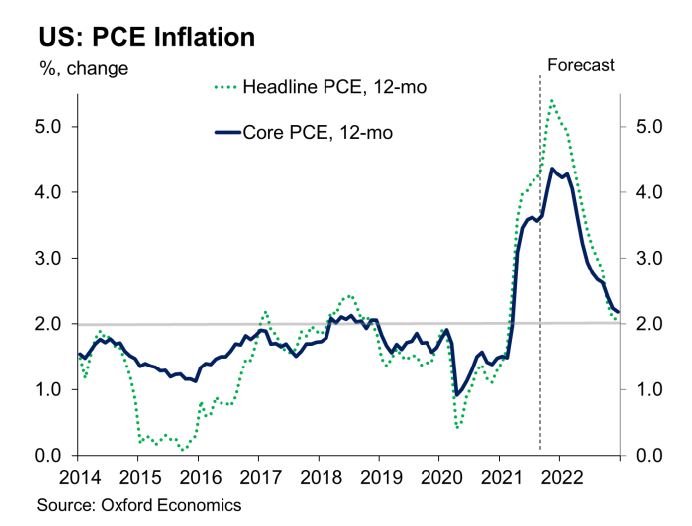

While these comments were made in an environment where the US economy remains strong with rapidly improving labour markets, investors were surprised by their tone, particularly following the emergence of a new Covid variant, with equities falling in value and government bonds rising as the potential for a policy error was priced in. Interestingly, Powell’s comments come as the worst of the supply chain disruptions appear to be passing; inflation, while high now, is expected to roll over sharply from Q1 next year, though risks to that view still abound, meaning unnecessary rate hikes could stymie growth at a crucial point in the recovery:

As implied above, the second driver of volatility in November was the emergence of worries around the new Omicron Covid variant. Equities sold off aggressively and safe-haven government bonds rose in value as the variant, identified in South Africa, was named one ‘of concern’ due to its unusually large number of mutations.

Data surrounding its transmissibility and potency relative to earlier variants remains unclear for now, as do data relating to vaccine efficacy. Reports are still largely anecdotal, but although the variant has already spread to 38 countries, the World Health Organisation (WHO) has reported no deaths directly linked to it and in fact is calling for cautious optimism as symptoms relating to Omicron appear to be mild. Indeed, the WHO has called the swift travel bans enacted on African countries by the likes of the UK ‘extreme’ and unsustainable.

This has not stopped many European countries from reimposing draconian restrictions on their respective populaces, with Austria becoming the first country to make Covid vaccinations mandatory by law from February 2022; a policy that has already been copied by others. In the UK, the wearing of masks in some settings has been reintroduced, but for now the Government has not deemed it necessary to do more, despite some of its scientific advisers urging renewed restrictions.

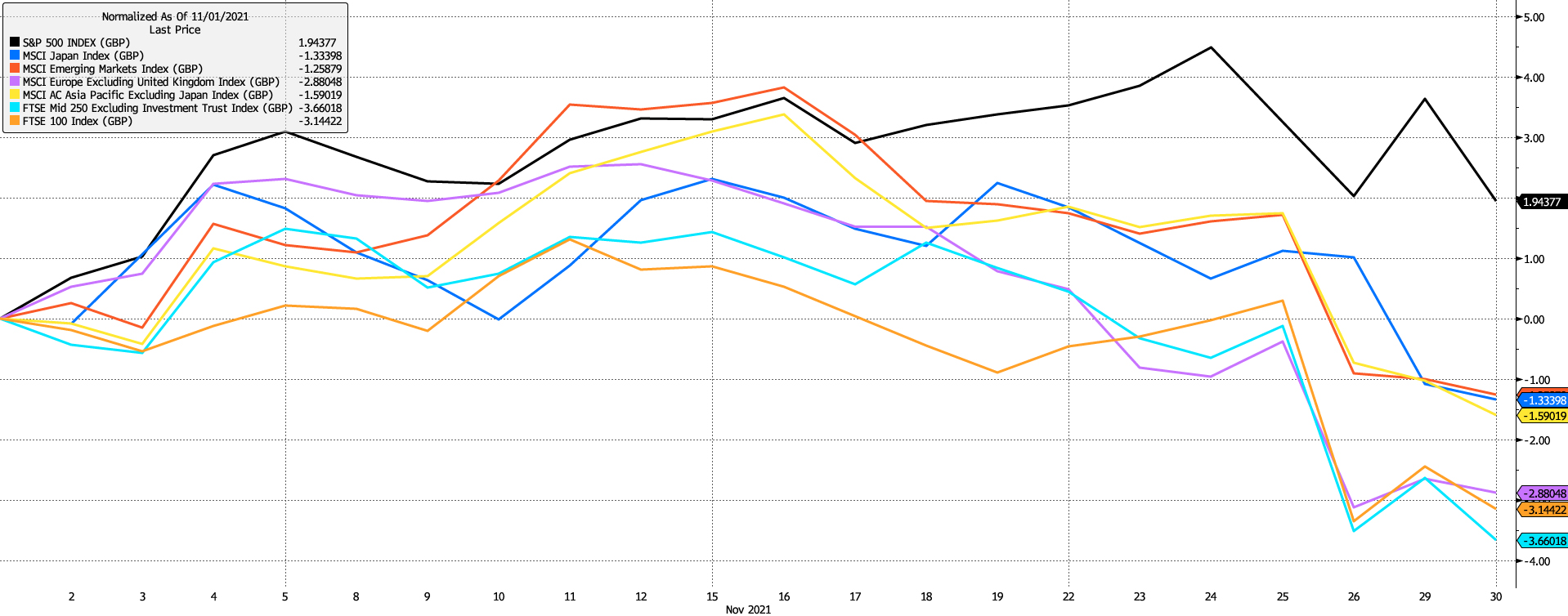

This news flow meant that all major equity regions were negative in GBP terms for November, bar the US S&P 500 which just about hung onto its gains, rising by 1.9%, though this index has fallen again in the first few days of December.

UK and European equities fared worst, losing 3.1% and 2.9% respectively, with Asian and Japanese equities caught in the middle, dropping by between 1.3-1.9%, per the chart below:

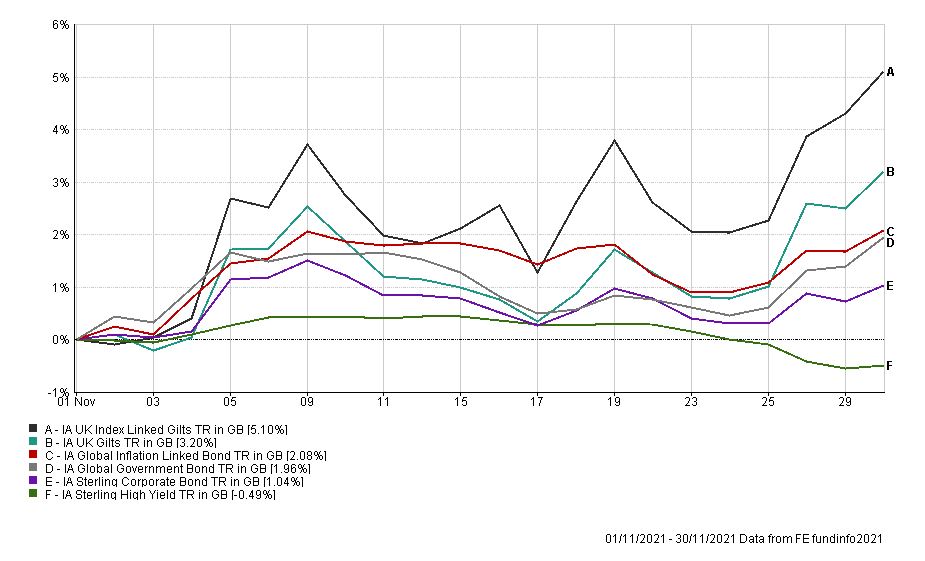

Conversely, government bonds saw good gains as investors flocked to ‘risk-off’ assets. As the chart below shows, UK Gilts performed well, with riskier corporate, high yield and emerging market bonds less so:

It is too early to call whether fears over Omicron are unjustified, though thus far the picture looks more positive than has been presented in the media. Should this variant be more transmissible but less harmful, its emergence may even be considered good news. For now, we should remain watchful of all incoming data and alert to any further downside risks.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

For further information, please contact:

For further information, please contact: