Market Updates

Positive sentiment was seen across global markets through November, with the global equity index closing up 8.1%, in what was the best month for equities in three years. Across developed markets, early signs that inflation levels are moderating and will retreat back to target levels through next year are providing investors with a good deal of confidence. Furthermore, recent data releases continue to reflect economic resilience, helping to reinforce the view that central banks have reached a peak in their rate hiking cycles, and may in fact move to cut interest rates sooner than was previously anticipated.

This adjustment in interest rate expectations provided a positive boost for both government and corporate bonds, leading the global aggregate bond index to gain 5.0% through the month. With bond yields in retreat, growth-oriented equities outperformed their value counterparts, while small- and mid-caps also rallied.

Elsewhere, movements in bond yields benefited real estate equities – however commodity markets suffered through the month. Despite ongoing tensions across the Middle East, elevated levels of oil output from both the US and the OPEC+ nations pushed the oil price lower, providing another source of positive impulse for global equities.

Gold was a notable outlier within the commodity index, continuing its upward trend from last month and closing November at a level very close to its all-time high. Throughout 2023, the gold price has shaken off the negative price pressures associated with higher real yields, instead rallying on the growing level of demand that has come from central banks looking to diversify their reserve assets.

As the chart above shows, equity returns across most major regions were positive, led by the UK’s mid-cap biased FTSE 250 index (in light blue), which posted its best month of the year, adding 6.9%. In contrast, the UK’s large cap index, the FTSE 100 index (the orange line), had a somewhat more lacklustre period, posting a modest gain of 1.8%, with the latter’s tilt towards commodities and value equities driving its relative underperformance.

In the US, the technology-heavy Nasdaq index (in pink) benefitted strongly from the pull back in bond yields, adding a further 6.6% (in GBP) through November. In local currency terms the Nasdaq gained almost 10.7% through the period, with the broad S&P 500 index (in light purple) also gaining a very respectable 8.9% in USD – however, a strengthening of the UK pound versus the US dollar led UK investors to experience lower translated returns.

Chinese equities (dark purple line) had another difficult month, falling 1.4% in pound terms and bringing year to date returns to -13.5%. While the region’s stock market continues to come under pressure from slowing growth, it would be remiss to forget that China is an $18 trillion economy, that is highly integrated into the global market. Its dominance pans numerous sectors, with the country responsible for the manufacture of 80% of the world’s solar panels and in control of 75% of global battery cell production. It is not, therefore, a region that should be written off as the result of a period of sub-par returns.

What’s more, November played host to a much-anticipated meeting between Chinese President Xi Jinping and US President Joe Biden. Tensions between the two regions have been running high for some years now, but early reflections on this meeting show it to have been constructive – with agreements made relating to climate change and military cooperation. Although this leaves countless trade barriers in place between the two countries, the direction of travel here is important, and in the longer term should help boost both Chinese, and global, equity markets.

In fixed income, falling yields led to strong price rises across the asset class. Having noted last month that yields on US 10-year Treasuries pushed above 5% for the first time since 2007, late November saw them fall back below 4.4%, reflecting the market’s growing conviction that the Federal Reserve will begin cutting interest rates as soon as March 2024.

This drop in government bond yields swiftly filtered through to corporate credit, as the above chart indicates, with US corporate bonds (in pink) outperforming and posting gains of 6.0%. Strong data releases, indicative of positive economic momentum, also benefitted investment grade and high yield credit, with spread compression seen across global bond markets. While recent months have seen spreads on US corporate bonds trade in line with their 20-year medians, November’s strong performance has led to a narrowing in spread levels, again suggestive of the market’s positive outlook for the US economy as we move towards the new year.

At both a corporate and government level, movements in European bond prices were slightly more subdued through the month, albeit gains were still made. While inflation across the Eurozone is clearly retreating, growth in the region remains depressed, with manufacturing activity data still sitting deep into contractionary territory and reports that European corporates are beginning to react by reducing staffing levels for the first time since 2021.

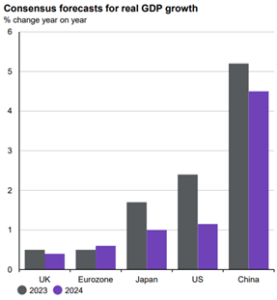

However, per the above chart, if we look out to next year, GDP growth across the Eurozone is expected to turn a corner and post an increase, as compared to this year – bucking the trend of other global regions. What this indicates, is that different regions are now at different stages in their respective cycles, which as we move through 2024, will provide an element of support to global growth as a whole.

From an investment perspective, we look to this as a source of optimism. Not only are we nearing the bottom of the cycle in some areas, but subdued stock market returns across numerous regions mean attractively valued, high quality companies, are not hard to find. While volatility will also certainly remain elevated, by retaining a clear focus on quality, valuation and upside potential, we believe there are ample reasons to enter the new year with an element of positivity.

We have over 1000 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.