Market Updates

Discover more insights from our Divisional Director, Peter Donaldson, and Investment Director, Oliver Stone as they delve deeper into last month’s market update.

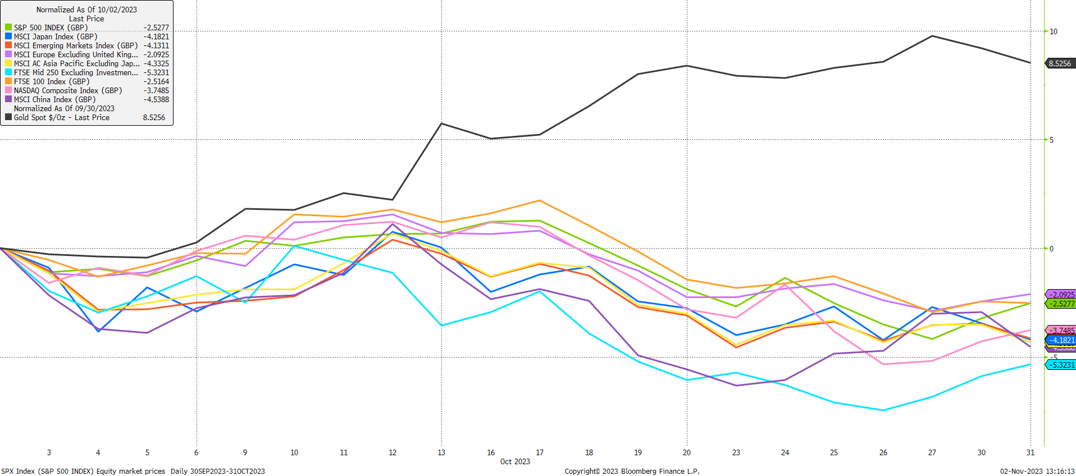

There was little positive news in October for equities. As the first chart below shows, equity indices fell to a greater or lesser extent through the month. Losses were driven by the prospect of ‘higher for longer’ interest rates which hurt equity valuations, while the Israel-Hamas conflict dampened risk appetite. Developed market equities outperformed emerging market equities over the month, growth stocks proved relatively resilient versus their value counterparts, and large-cap companies outperformed small-caps, all of which continued the trend of 2023.

Commodities were a notable outperformer during the month, with prices reversing some of their year-to-date losses on the back of the tragic events that unfolded in the Middle East. Oil prices rallied amid concerns that an escalation into a wider regional conflict could disrupt oil supply, but most notably we saw a flight to gold as a safe haven, whose price rose by 8.5% in pound terms (black line).

The gold price is currently hovering around the $2,000/oz mark again despite real interest rates and the US dollar having moved higher, showing that it’s still a genuine hedge for geopolitical risk:

Europe (purple line) was marginally the best performing region, just pipping the US (green line) to top spot despite falling by around 2%, with UK large-caps (orange line – FTSE 100) also there or thereabouts in falling by 2.5%. US indices wobbled towards the end of the month as some of the “Magnificent 7’s” Q3 earnings reports disappointed investors, but they rallied into the end of the month and have started November extremely strongly.

October saw a flurry of data signalling the resilience of the US economy, including a blockbuster jobs report, strong retail sales data and a blowout GDP print of 4.9% annualised for the third quarter. Inflation came in hotter-than-expected, with the headline figure flat at 3.7% year on year in September, against expectations of a slight moderation.

Chinese equities (dark purple line) were weak once again, falling by 4.5% despite there being some positive upside surprises in their third quarter GDP numbers, industrial production and retail sales. Nonetheless, continued weakness in the real estate sector, and reports of new US restrictions on AI chip exports to China further dampened market sentiment, and China’s poor performance dragged down the MSCI Asia ex-Japan Index (yellow line) and the MSCI Emerging Markets Index (dark orange line), which both fell by mor than 4% on the month.

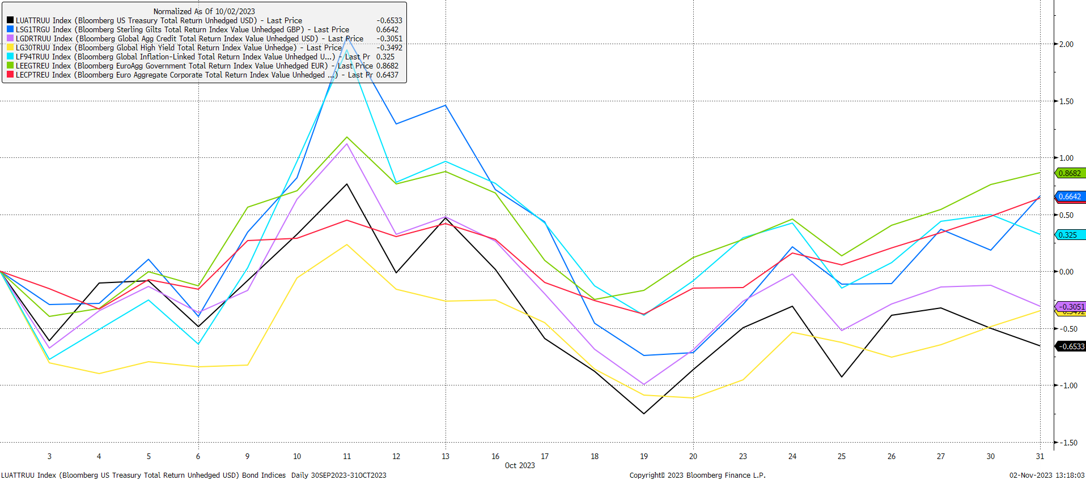

In fixed income, returns from US-focused indices were negative, but we saw brighter spots elsewhere, as the second chart below shows. During the month the US 10-year Treasury yield pushed above 5% for the first time since 2007, driven by a combination of buoyant economic data making ‘higher for longer’ rates look increasingly likely, and concerns around the sustainability of government finances. A move higher in yields was seen throughout the global government bond market and in credit, widening spreads dented monthly returns for both investment grade and high yield bond markets.

US Treasuries (black line) fell by 0.65% during the month, with similar losses seen for global investment grade corporate bonds (purple line) and high yield bonds (yellow line); both of which indices are dominated by US exposure.

But elsewhere there were positive returns, with European (green line) and UK government bonds (dark blue line) outperforming, and rising by 0.86 and 0.66% respectively, after central banks paused rate hikes again during the month.

Outside of financial markets, attention was fixed on the tragic events unfolding in the Middle East where a surprise attack was carried out in early October by Hamas on Israel with truly appalling, indiscriminate killings of civilians and hostage taking, which has resulted in a strong retaliation by Israel via a ground invasion of Gaza.

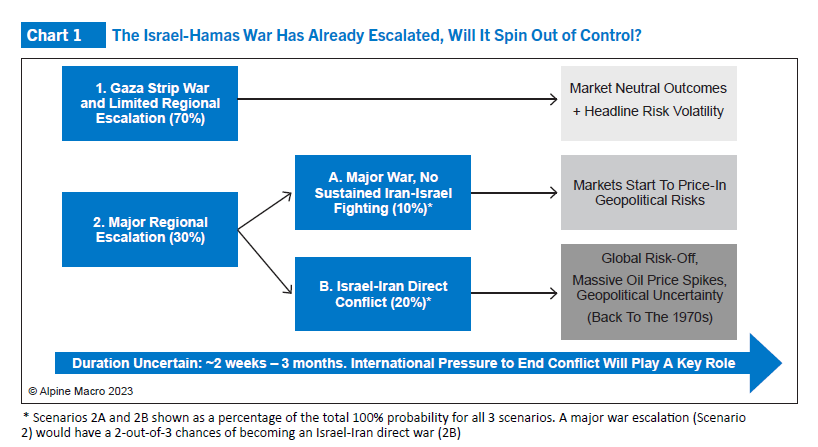

The key question for investors is to try and understand how widely the conflict will spread, and what impact it may have on global markets, with the third chart below from the team at Alpine Macro succinctly illustrating a range of potential scenarios that are probabilistically weighted:

The Alpine team ascribe a 70% probability to the first scenario at the top of the chart unfolding – a limited regional escalation – which will and has seen an Israeli ground invasion coupled with already mounting international pressure to limit the conflict as casualties mount. There will and have been threats from other regional actors – namely Iran and Hezbollah – to escalate, but this scenario expects minimal regional escalation, avoiding a major regional war.

The rationale for this is that the U.S. has already deployed significant naval and marine forces to the Eastern Mediterranean, providing a deterrent, and that despite most Arab states supporting the Palestinian cause, there is little appetite for an expanded war, or for that matter a victory for Hamas, Hezbollah, and Iran.

Moving to the second and third scenarios, these carry a much higher level of risk and could create significant market turmoil. While they do carry a low level of probability, scenarios that involve an escalation of conflict drawing in more actors, and particularly ones that directly involve Iran, must be considered given the potential impacts on notably the global oil price. Any attack on Iranian infrastructure and resulting escalation would disrupt Persian Gulf oil exports, and potentially draw the U.S. into the fray.

For now, there has been limited escalation outside of the main protagonists, but risks remain, and regardless of any market outcomes these events add to the wave of geopolitical risk we’re seeing unfolding more widely.

Looking ahead to the final months of 2023, it remains key to be diversified across asset classes, strategies and geographies as volatility is likely to remain elevated. October saw major central bank meetings take place in Europe, UK, US and Japan, with governors all ‘pausing’ interest rate hikes, but still at pains to point out their fight against inflation is not yet won, and to expect rates to remain higher for longer.

The lagged effects of much tighter monetary policy globally are still only slowly starting to filter through to the real economy, and market conditions may well continue to be fractious. Despite this uncertainty, we still see many good looking opportunities across the financial landscape, particularly within unloved parts of the equity market which should play out over the medium term and reward patient investors.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.